What is the issue?

Income transfer policy combined with direct cash transfer should be implemented to address farmers’ issues.

What are the possible solutions?

- The most pressing problems facing the Indian farmer are the persistently low market prices.

- The prices of many crops in India are much below expectations and normal trends.

- Ideally, the solution lies in holistic and broad-based agri-market reforms like -

- Removing APMC monopoly

- Reforming the Essential Commodities Act

- Scaling up negotiable warehouse receipt (NWR) system

- Innovations in building up value-chains

- Relaxation of land laws

- Promoting contract farming and agri-exports

- However, these reforms entail a long gestation period and hence demands for quick-fix solutions are increasing.

- These quick-fix solutions lie in the form of higher minimum support prices (MSPs), loan waivers and direct income/investment support.

Can MSP and loan waiver address farm distress?

- MSP - The MSP policy pertains to a limited number of farmers.

- As per NSSO 2012-13, less than 10% of the country’s farmers sold their produce at MSPs.

- Moreover, MSP operations mostly benefit large farmers who have marketable surplus.

- These operations exclude much of country’s marginal farmers who produce little surplus.

- Besides, the large inefficiencies and market distortions caused by a MSP-regime make it an unfavourable choice.

- For example, wheat and rice stocks with the government (45.4 MMTs) are more than twice its buffer-stock norms (21.4MMTs), reflecting massive economic inefficiency.

- Along with it, the problems of leakages and corruption in the MSP operations of procurement, stocking and distribution prevails.

- Also, there was a difference in the MSP increase formula (C2 cost or A2+FL) offered by the different states.

- It may be noted that C2 is about 38% higher than A2+FL and many states follow the A2+FL model.

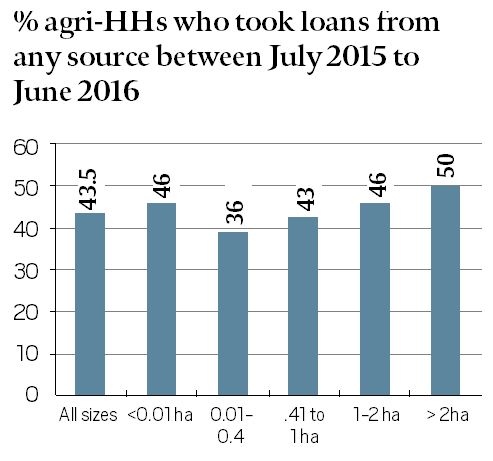

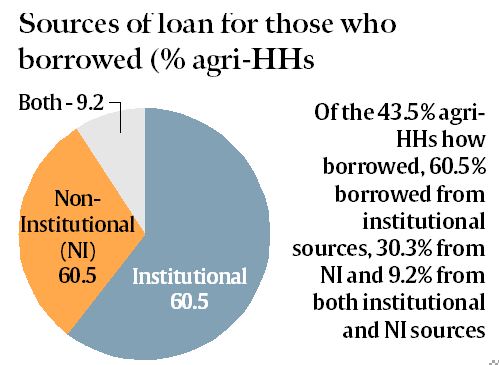

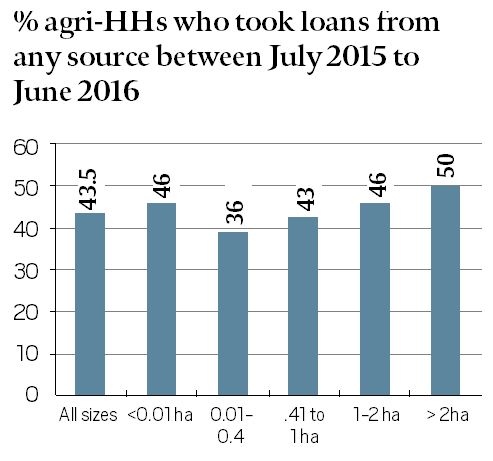

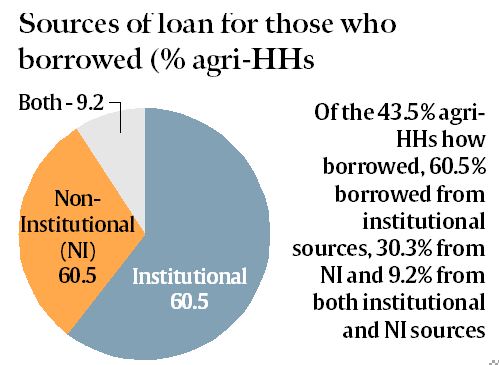

- Loan waiver - As per NABARD’s Financial Inclusion Survey (NAFIS), between July 2015-June 2016, 43.5% of all agri-households took loans.

- It also reveals that a total of about 30.3% of Indian agri-households took loans from institutions.

- A loan-waiver is thus likely to benefit only this 30% and the remaining 70% of Indian farmers, who do not access institutional credit, will not benefit from this scheme.

- Such high rates of exclusion must be the single-most important failure of our banking system with regard to financial inclusion.

- Thus, it can be seen that, through higher MSPs or loan-waivers, one cannot reach more than 20 to 30% of Indian farmers.

- This limited reach, therefore, cannot redress the widespread grievances of Indian farmers.

What should be done?

- The problems can be resolved by income/investment support like the Rythu Bandhu Scheme (RBS) of Telangana.

- Under the scheme, the government gave Rs 4,000 per acre to every farmer.

- This transfer is made twice a year, coinciding with two cropping seasons to support the input purchases of farmers. Click here to know more.

- The scheme is said to have reached almost 93% of landowners and also budget-friendly to the state government compared to loan waivers.

- In terms of costs, a national farm-loan waiver is likely to cost about Rs 4 to 5 trillion.

- An income transfer scheme is likely to cost about Rs 2 trillion, even while increasing the coverage to include even tenant farmers in the future.

- Only a cost-sharing arrangement between the Centre and states is required to bear the financial burden of the states.

- Thus, an income transfer policy for farm inputs should be rolled out on national scale combining with the existing direct cash transfer in case of fertiliser and power subsidies.

- The government should acknowledge this reality of farm distress and tries to resolve it on priority.

Source: The Indian Express