NK Singh Committee:

- The original objective of the Fiscal Responsibility and Budget Management Act was to bring down the fiscal deficit to 3% of the GDP by March 2008 but in the aftermath of the global meltdown, the Act was first postponed and later suspended in 2009.

- A committee headed by N.K. Singh was formed to reconsider reinstating the provisions of the Act has submitted its report. The report is not in the public domain but it is in favour of fiscal consolidation but not sacrificing growth.

On what sector the budget should focus on?

- While no one can question the importance of keeping the fiscal deficit low, the budget should also focus on reform in the banking sector. The banking system plays the most critical role in carrying out the government’s development agenda but precious little is being done for the banks.

- Many of the government-owned banks that have around 70% share of banking assets are laden with bad loans and need capital to stay afloat.

- The RBI’s December Financial Stability Report has pointed out that the gross non-performing loans of the Indian banking industry rose to 9.1% in September, thus pushing the overall stressed loans to 12.3% from 11.5%.

- While these reflect the health of the industry, the state of affairs in the public sector banks is far worse. In fact, the report has said that the public sector banks may record the highest bad loans and lowest capital adequacy ratio, a measurement of capital against risk-weighted assets, among all banks.

Has the government done anything to address these issues?

- The government had held an offsite with the banking bosses, Gyan Sangam, in Pune, in January 2015. Addressing the bankers, Modi had said it was a “unique initiative” and “the first step towards catalyzing transformation”.

- In August 2015, finance minister Arun Jaitley announced the grand Indradhanush plan—the “solution to the problems” of the industry, which Modi explored in Gyan Sangam.

What does the Indradhanush plan promise?

- Govt. describes the Indradhanush framework for transforming the PSBs as “the most comprehensive reform effort undertaken since banking nationalisation in 1970”.

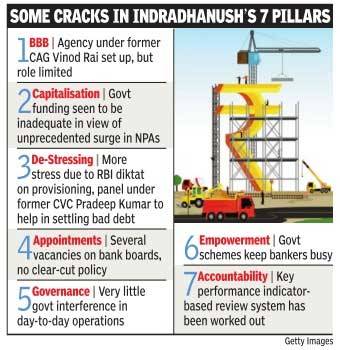

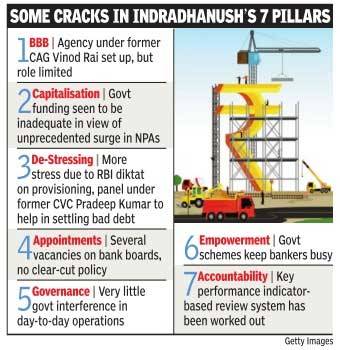

- It promises to tackle several critical issues, including appointments, capitalization, stress in the system, empowerment, accountability and governance reforms to revamp functioning of the government-owned banks.

- Estimating the capital requirement between fiscal year 2015 and 2019 at around Rs 1.8 trillion, the government has committed to pump in Rs 70,000 crore in phases till 2019 when the new Basel norms kick in.

- It also feels that the public sector banks’ (PSBs) market valuations will improve significantly following governance reforms, tight bad loan management and risk controls, significant operating improvements and, of course, capital allocation in successive budgets.

- Higher valuations, coupled with sale of non-core assets as well as improvement in performance would enable these banks to raise money from the market.

- It also issued a circular that said there would be no interference from the government and the banks would be encouraged to take their decisions independently, keeping the commercial interest of the organization in mind.

Is Indradhanush a successful measure?

- If indeed setting up of the Banks Board Bureau with a string of vague and ambiguous terms, and appointing a few private sector bankers as heads of PSBs are meaningful reforms, then Indradhanush has done wonders.

- Even though the credit growth has been far lower than what has been estimated, the banks would need higher capital as growing bad assets are eating into their capital but none has any idea what’s happening on that front.

- The banks are required to set aside money or provide for their bad assets and that erodes their capital. As far as the Banks Board Bureau is concerned, I wonder whether even the members of the Bureau themselves know what they are expected to do.

- Barring the top level appointments, all other assignments are vague and even here, the Bureau does not have the final say.

- One-fifth of Indian Overseas Bank’s loans have turned bad and it has recorded losses for six successive quarters till December but it doesn’t have either the chairman or a managing director and CEO for seven months since its last boss retired.

- Apparently, the Bureau recommended the executive director of a PSB for this position and it was cleared by the vigilance authority, but a division of the finance ministry shot it down. Clearly, there is a disconnect between the ministry and the Bureau.

- The Bureau also recommended nine candidates for the posts of executive directors in various PSBs in September, but none of them has been appointed as yet.

- Moreover, it does not have the power to appoint the so-called non-official directors at boards of PSBs, many of whom are the root cause of mis-governance in banks.

- The government’s plan to dilute ownership in IDBI Bank has also gone nowhere. Similarly, the employee stock option plan or ESOPs for PSBs remains a promise on paper so far.

Concluding remarks:

Barring a few cosmetic changes, nothing significant has been done to revive the public sector banks. I would love to see the finance minister using this budget to move forward with a concrete reform agenda.

Category: Mains | GS – III | Economy

Source: Live Mint