Why in news?

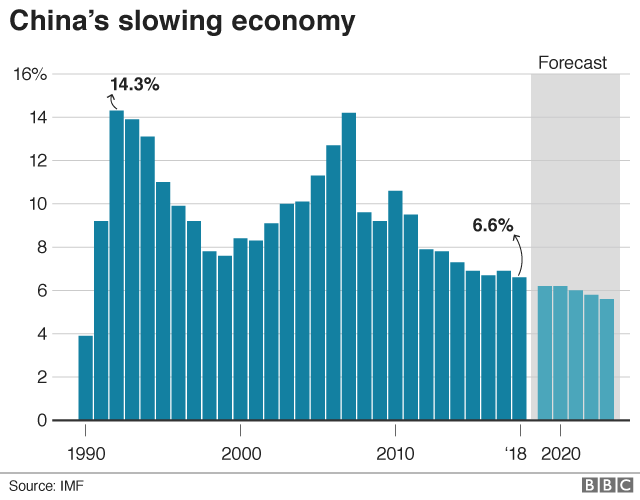

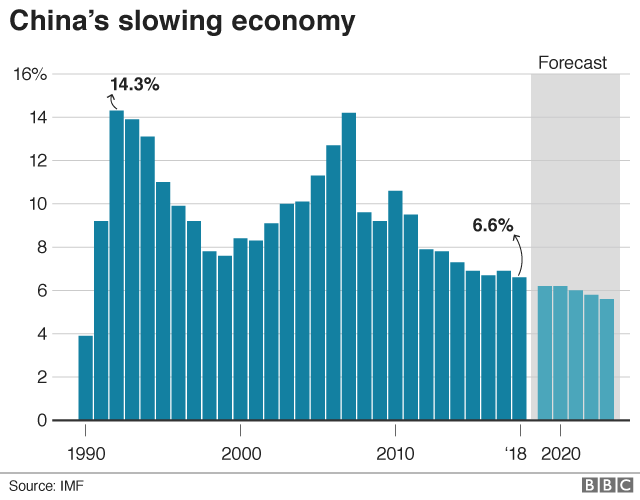

The growth of gross domestic product (GDP) in the People’s Republic of China (PRC) has slowed to 6.6% in 2018.

Why is it a concern?

- Fourth-quarter growth (year-on-year) was 6.4%, indicating that the economy was decelerating.

- A $12 trillion economy growing at over 6% is still a powerhouse.

- But by far the biggest contributor to global growth, the latest numbers are a cause for concern.

- It is remarkably low for that country and is the lowest that GDP growth has been since as long ago as 1990.

What is the cause?

- The growth slowdown is less cyclical and more structural.

- Three decades of super-charged growth in mainland China was delivered by a very specific investment- and export-driven model.

- Financial savings and foreign investment were routed to large, capital-intensive projects and export-focused manufacturing.

- This allowed employment and incomes to grow significantly.

- Eventually, the PRC became the world’s factory, running large trade surpluses with most countries.

- After the global financial crisis of 2008, the government made the choice to multiply on this model.

- It took advantage of the cheap credit to various capital-intensive sectors.

- But, while growth remained robust, the productivity of capital declined severely.

- In the past year, three-fourths of growth has come from consumption.

- This indicates that the consumption-focused sectors of the economy have now become the engines of progress, signalling an imbalance.

What should China do now?

- Beijing is well aware of the above structural problem.

- There has been talk of “rebalancing” the economy away from exports and an investment obsession towards innovation and consumption.

- To move from upper-middle income to high-income status (to avoid the “middle income trap”), China would have to raise productivity.

- This has to come from moving up the value chain and embedding greater innovation in all its processes.

What are the challenges therein?

- The rebalancing process would naturally lower growth during the transition.

- So implementing the changes is harder given the political pressures to ensure that growth remains high and incomes keep on rising.

- Thus, the credit flow to unproductive sectors of the economy cannot be stopped entirely.

- Furthermore, empowering the private sector, which is a necessary next step in the rebalancing, is contradictory to China's recent policy.

- Also, with enough resources being spent on research, integrating the products thereon into final output has been much harder.

- Given these challenges, the trade tensions with the U.S. may actually help in China's attempt to de-emphasise exports’ importance.

What does this mean for India?

- For India, the question is how much this structural slowdown will affect its own growth trajectory.

- An opportunity has opened up to insert India further into global supply chains.

- But, it is also essential to ensure that there are substantive domestic reforms to take advantage of the above.

Source: Business Standard