What is the issue?

Consumption of plastic in the Asia-pacific region is getting higher and hence companies need to demonstrate their own reduction commitments.

What is the background?

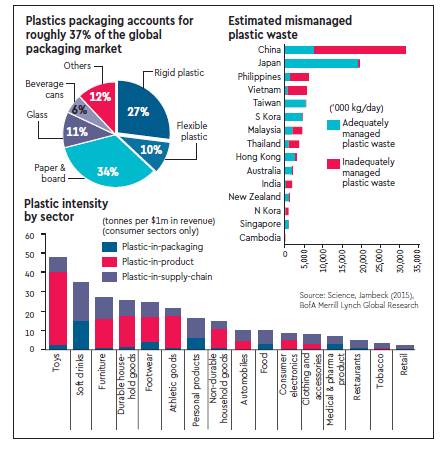

- Asia consumes 50% of global plastic packaging, which could quadruple by 2050.

- Food, beverage and healthcare represent 75% of plastic packaging use.

- New consumption patterns, including Asia’s rising appetite for e-commerce and food delivery add to demand for plastic packaging.

- However, recycling rates are low, with the exception of Japan (83%) and Taiwan (35%).

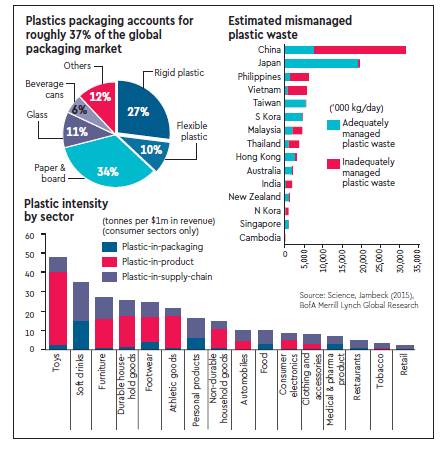

- Hence the region contributes 82% of plastic waste which leaks into oceans with China, India and ASEAN contributing 2.7-7.3million tonnes per annum.

What are the concerns?

- Plastic represents 37% of packaging in Asia, worth $150 billion.

- Though there are obvious benefits of using plastic like durability, safety, hygiene, and lightweight, 95% is designed for short-term (single) use and could take more than 500 years to biodegrade.

- Since the early 1950s, more than 8.3 billion tonnes of plastic has been produced globally.

- But only 9% of plastic waste ever produced has been recycled, 12% incinerated and 79% ended up in landfills, dumps or the natural environment.

- Plastic waste dumping in the ocean is becoming an increasing environmental concern.

- The major rivers in Asia carry more than 90% of plastic waste in the ocean.

- The Asia-Pacific Economic Cooperation (APEC) estimates that the cost, due to plastic pollution, to tourism, fishing and shipping industries was $1.3billion in the region alone.

- Also, majority of the plastic waste in Asia is “mismanaged”, wherein low economic value contributes to nearly 45% of Asia’s plastic waste getting mismanaged (i.e., dumped).

What is the reason behind low plastic waste collection rate across the world?

- Low economic value - 80% of plastic waste has low residual value such as plastic bags.

- Alternatively, higher recycling for aluminium cans (55%) fetches sufficiently high selling prices relative to collection costs, thus making it economically attractive.

- Poor separation at source – Plastic collection often involves co-mingling of paper, glass and aluminium and majority of the sorting occurs manually.

- High rate of pigment contamination - Clear plastics have the highest value and are preferred in the recycling market.

- Dyed and pigmented plastics contain contaminants and are often disposed rather than recycled.

- Cheaper to dump or export than to recycle - With the absence of subsidies from the government, it is often cheaper to export and dump plastic waste in landfill.

What should be done?

- In January 2018, China banned the import of plastic waste.

- Prior to the ban, China imported up to 56% of global exported plastic waste.

- The largest exporters of waste to China included the US, the UK, the EU and Japan.

- After China’s ban, we are likely to see more stringent plastic waste policies introduced across the globe and in Asia.

- Also, there is growing acceptance of plastic reduction in many companies in Asia.

- Thus, reduction in quantity of material per package and use of recycled materialby the companies will demonstrate commitment to plastic waste reduction in the future.

Source: Financial Express