Why in news?

CSO has released the data for the third quarter of 2016-17 (Oct-Dec) and concluded that the GDP in Q3 grew by 7% and the growth rate for the whole year would be 7.1%.

Did demonetisation impact economic growth?

- The CSO data did not answer that question.

- The argument that demonetisation did not and will not have a negative impact on the economy is very hollow and immature.

- Even the former CSO chief statistician, after reviewing the data, has concluded that the data (of 3rd quarter) is deficient and the growth rate for the whole year is likely to be revised downward to 6.5%.

- After the changeover to the new methodology, the CSO publishes estimates of Gross Value Addition (GVA) and GDP.

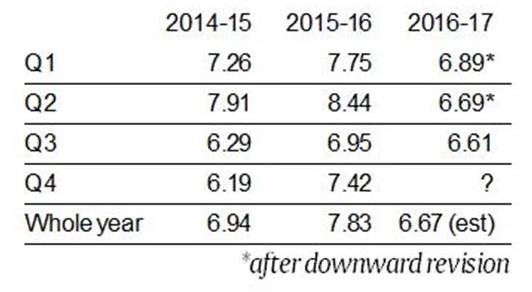

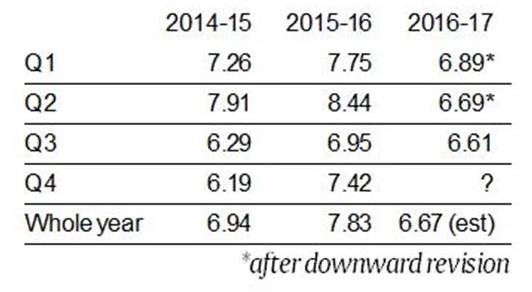

- GVA growth rates during three years is given below:

- Demonetisation affected every sector of the economy except three.

- it did not affect government expenditure. And the govt actually increased its spending after November 8, 2016;

- it did not affect the monsoon. Since it was bountiful, it boosted agricultural production; and

- it did not affect the revenues of utilities. Actually demonetised notes were allowed to be used for paying utility bills.

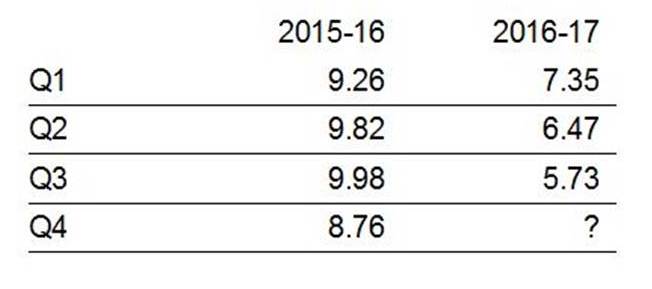

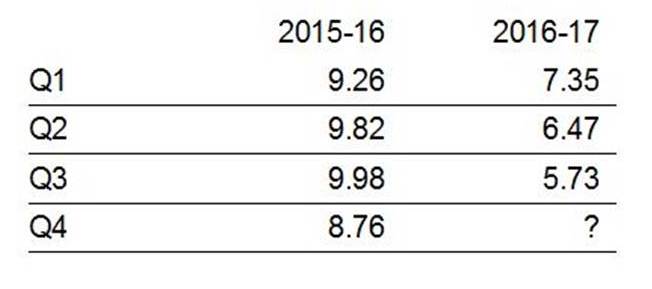

- Therefore, if we look at the GVA growth rates after excluding government, agriculture and utilities, it will show the real picture of the economy. And it looks like this:

What conclusion can be made from above?

- From the above data, it is clear that economic growth in the non-government, non-agricultural economy slowed down since Q4 of 2015-16.

- Demonetisation that happened in the middle of Q3 actually accelerated the decline of economic growth.

Why the situation is still bleak?

- While the GVA/GDP data may have given a surprise, other indicators point to an economy that is not investing more, not producing more and not creating more jobs.

- Compare the GVA growth numbers in Q3 of 2015-16 and Q3 of 2016-17. In the Mining, Manufacturing, Construction, etc., the GVA growth number has declined sharply in 2016-17.

- In Q3 of 2016-17, the Index of Industrial Production (IIP) recorded a meagre growth of 0.2%.

- Bank credit growth to industry was negative at 4.3%.

- By September 2016, net fixed assets of all firms had declined by 9.36%.

- When data for the informal sector is also captured, the GVA growth number will be moderated and will be lower.

Source: The Indian Express