Click here to understand the basics of GST

Why in news?

Goods and Services Tax (GST), a historic tax reform, comes into effect today.

What are the basic changes?

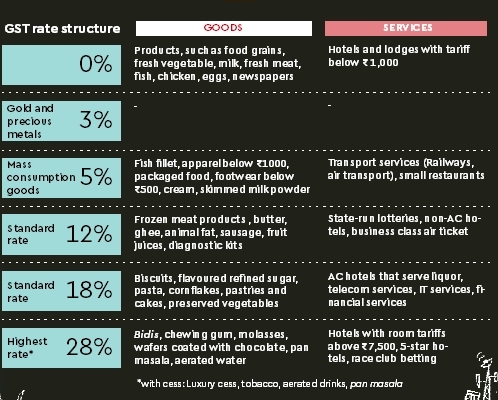

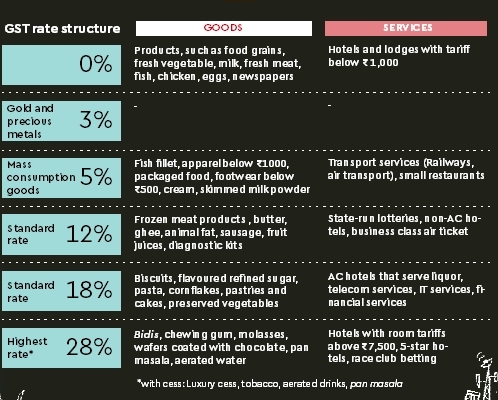

- There would be a single tax law and four tax rates—5%, 12%, 18% and 28% - that would be charged by the Centre and the states.

- The government has set a 3% tax rate for gold jewellery, while a majority of goods and services will be taxed at a rate of 18%.

- Also, a number of goods and services have been exempted from the tax structure.

- Tax rates under GST have been largely kept at existing levels for most sectors.

- Fast moving consumer goods like soaps, tooth paste, hair oil and SUVs will cost less.

- Luxury hotels, aerated drinks, tractors will attract higher tax.

- The threshold limit for exemption from levy of GST is Rs 20 lakh for the states except for the special category northeastern states, where it is Rs 10 lakh.

- A cess would be levied on certain goods such as luxury cars, aerated drinks, pan masala and tobacco products, over and above the GST rate of 28% to recover amount for compensation to the states.

- The liability to pay GST on purchase of goods from unregistered dealer is on the receiver (registered dealer) of the goods/services.

- This will improve tax compliance and benefits organised players.

- At the last minute, GST Council decided to reduce the tax rate on fertilisers from 12% proposed earlier to 5% and the rate for “exclusive parts of tractors” have been reduced from 28% to 18%.

- These moves would nullify the chances of prices of these key farm inputs rising under GST.

What are the advantages?

- GST will significantly reduce the transaction cost of doing business in India.

- It will bring in transparency and encourage investments in organised sectors.

- It will create a level playing field between unorganised and organised segments.

- Octroi is a local tax collected on various articles brought on interstate borders. GST will lower logistics costs due to the decline in transit time because of elimination of these multiple check points.

- All transactions and processes will be done through electronic mode.

- It provides for the facility of auto-populated monthly returns and annual return.

- The objective of including real estate within a reasonable time period is welcome because besides expanding the tax base, this will help in fighting black money.

- Seeding of PAN in GST registration will make it difficult for businessmen to evade the tax.

What are the problems?

- Petroleum products are presently kept out of GST and cascading effect on that account will continue.

- They contribute over 35-40% of revenue from indirect taxes.

- Multiple rates might rob much of the benefits due to increased lower administrative, compliance and distortion costs.

- There will be increase in classification disputes, and subsequent lawsuits.

- Requiring the regular GST dealers to file 37 returns in a year raises anxiety.

- The electronic technology platform of the GST system is untested.

What should be done?

- Instead of viewing the GST as a game changer, it is useful to see it merely as the next stage of consumption tax reform in the country.

- Include petroleum products within the ambit of the GST, will help offset the revenue loss due to the prevailing high rates on petroleum products.

Source: The Hindu, The Indian Express