Why in news?

Foreign investors have sold a net $1.12 billion in Indian debt market (primarily bonds) this month, the highest since December 2016.

What are bonds?

- A bond is a debt investment.

- Corporates or governments issue bonds directly to investors, instead of obtaining loans from a bank.

- This is to raise money and finance a variety of projects and activities.

- The investor buys the bonds and loans money to the entity and in turn receives fixed interest.

- This is for a defined period of time (till maturity date) and a variable or fixed interest rate (coupon rate).

How are bond prices, bond yields and interest rates related?

- Price - Face value is the money amount the bond will be worth at its maturity.

- It is also the reference amount the bond issuer uses when calculating interest payments.

- The issuance price of a bond is typically set at par, usually $100 or $1,000 face value per individual bond.

- But a bond's price changes on a daily basis, just like that of any other publicly-traded security.

- The actual market price of a bond depends on various factors including:

- the credit quality of the issuer

- the length of time until expiration

- the coupon rate compared to the general interest rate environment at the time

- Interest rates - The price of a bond primarily changes in response to changes in interest rates in the economy.

- For instance, say the investors get a better return in corporate bond either due to rise in their rate or due to fall in rate of government's bond.

- This would make the corporate bond much more attractive.

- Investors in the market will bid up the price of the bond until it trades at a premium that equalizes the prevailing interest rate environment.

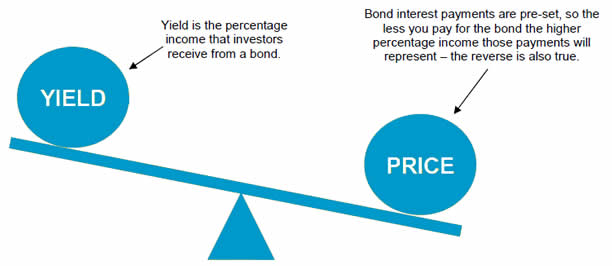

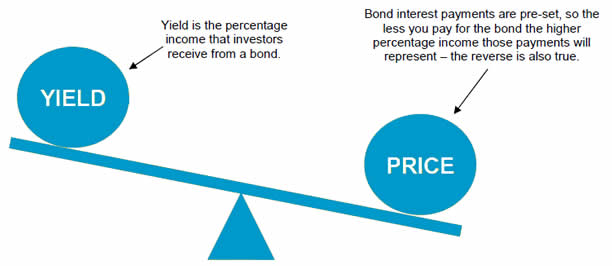

- Yield - In simple terms, yield is the amount of return that an investor will realize on a bond.

- If the investor holds the bond to maturity, s/he will be guaranteed to get the principal amount back plus the interest.

- However, a bond does not necessarily have to be held to maturity by the investors.

- Instead, investors may sell them for a higher or lower price to other investors.

- The bond prices and yields generally move in opposite directions.

- This is because, as a bond's price increases, its yield to maturity falls.

- E.g. for a bond purchased with a par (face) value of $100, and a 10 percent annual coupon rate, its yield would be 10% (10/100 = 0.10)

- If the bond price fall to $90, the yield would become 11% (10/90 = 0.11).

What is happening to Indian bonds?

- Indian bonds were once regarded as hot emerging market play.

- The country received about $26 billion in inflows last year through this.

- Notably, higher bond yields and stable currency have been driving factors for its attractiveness.

- But Indian bonds are now losing their allure with foreign investors.

- The 10-year bond yield dropped to as much around 7.3% from 7.62%, its lowest since January end.

What are the driving factors?

- Rupee - Rupee weakness is one of the major reason for the change in investor sentiment.

- The partially convertible currency has lost nearly 2% against the US dollar this year.

- A fall in local currency ultimately erodes returns for foreign investors.

- US Fed Rate - The interest rates hikes in the US could lead to outflow of foreign portfolio investor funds from emerging markets.

- This is a concern for India, as funds would move out of the country to be parked in US Treasury bonds.

- Economic concerns - Inflation has stayed above the RBI's 4% target for 5 consecutive months.

- Adding to this is the fear of the central bank raising the interest rates further.

- Moreover, rising energy prices are widening India's trade and current account deficits.

- The government has also loosened its fiscal deficit targets to finance increased spending ahead of general elections due by 2019.

- Banks - The public sector banks, typically the biggest lenders to the government, have turned wary of lending.

- State-run banks are unable to buy government bonds amid widening treasury losses.

- This inability also reduced confidence in the country's debt.

- State-run lenders are estimated to be been selling Rs 5.30 billion of government debt on average every day this year.

What is the way forward?

- Domestic investors are already concerned with widening fiscal deficit.

- Banks hold about 30% of the government bonds while foreigners own about 7.5%.

- Thus foreign selling is also now adding pressure on the market.

- A new investor class is needed to absorb upcoming bond supply.

- It is thus essential that the RBI re-examine the rule limiting the role of foreign investors in the bond market.

Source: The Hindu, Economic Times