What is the issue?

- The meeting of the Board of Directors of the Reserve Bank of India (RBI) was held recently. Click here to know more on the Board.

- The outcome of the meeting gains significance in the backdrop of the tussle between the RBI and the Government.

What are the highlights?

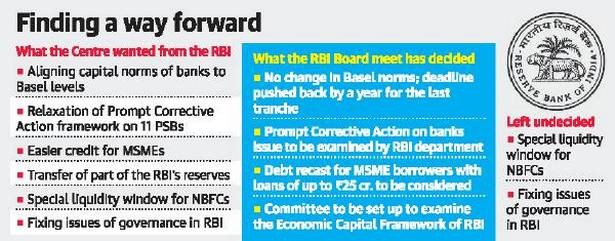

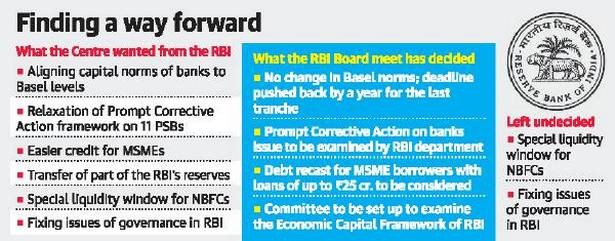

- The central bank and the finance ministry appeared to put aside some of their differences to resolve some key issues.

- Surplus - It was decided to set up a committee to discuss the controversial issue of surplus reserves transfer to the government.

- The Board discussions were outside the purview of Section 7.

- ECF - The board decided to constitute an expert committee to examine the Economic Capital Framework (ECF).

- The membership and terms of reference of ECF will be jointly determined by the Government and the RBI.

- Lending - The Board also decided to consider relaxation of lending norms for banks under Prompt Corrective Action regime.

- The RBI’s Board for Financial Supervision would study this issue.

- Basel Norms - The board decided to retain the CRAR (Capital to Risk (Weighted) Assets Ratio) at 9%.

- It has however liberalised the implementation of the capital adequacy norms under the Basel III norms.

- It agreed to extend the deadline by one year, for banks to set aside an additional 0.625% as capital conservation buffer (CCB).

- CCB is the additional capital that banks have to own beyond the mandatory minimum capital requirements.

- The postponement means banks have more time till 2020 to meet these norms.

- Stretching the implementation of the norms will release high-cost capital, thereby reducing borrowing costs.

- NBFCs - There was a demand from the government for special window of liquidity for non-banking finance companies.

- But the RBI appears to have convinced the government on this.

- It said that it was not essential at this point, with companies continuing to borrow money from the market.

- MSME - The board also advised that RBI should consider a scheme for restructuring of stressed standard assets of MSME borrowers with aggregate credit facilities of up to Rs 250 million.

- Restructuring stressed assets of mid-sized and small SMEs is likely to provide them a buffer.

- This would ease credit flow to MSMEs and address their credit concerns, when liquidity and cash flows have been squeezed.

- Next meet - The differences between RBI and the Government on other key issues are unlikely to be resolved soon.

- The next board meeting is thus likely to take up the equally contentious issue of the RBI’s governance structure.

- It is also likely to consider PCA norms and the liquidity issue.

What is the significance?

- The Board has played a significant role, in fact, for the first time in recent memory, from being just an advisory body.

- The decisions taken address the concerns of both the Centre and the central bank.

- The discussions balanced the need for enhancing credit flow as well as maintaining financial stability.

Source: Economic Times, The Hindu

Quick Fact

Prompt Corrective Action (PCA)

- RBI has initiated prompt corrective action (PCA) in as many as 11 PSBs, which is primarily an action plan for weak and troubled banks.

- The RBI has put in place some trigger points to assess, monitor and control banks.

- The trigger points are on the basis of CRAR (a metric to measure balance sheet strength), NPA and ROA (return on assets).

- Based on each trigger point, the banks have to follow a mandatory action plan. RBI could take discretionary action plans too apart from these.

- It prohibits them from undertaking fresh business activities such as opening branches, recruiting talent or lending to risky companies.