Why in news?

Revenue collections from GST still remain below the target set under the Budget 2018.

How does the GST collections fare thus far?

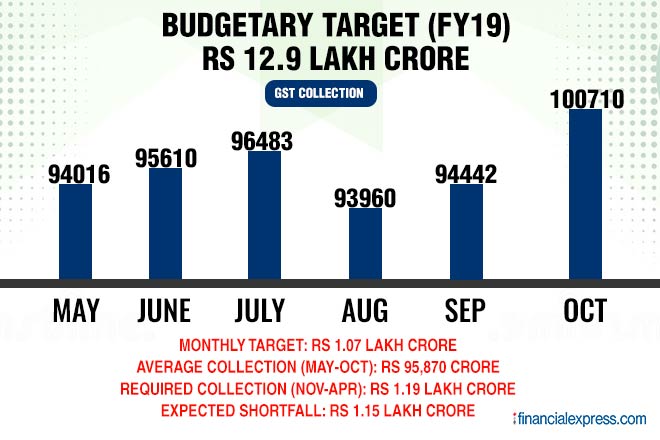

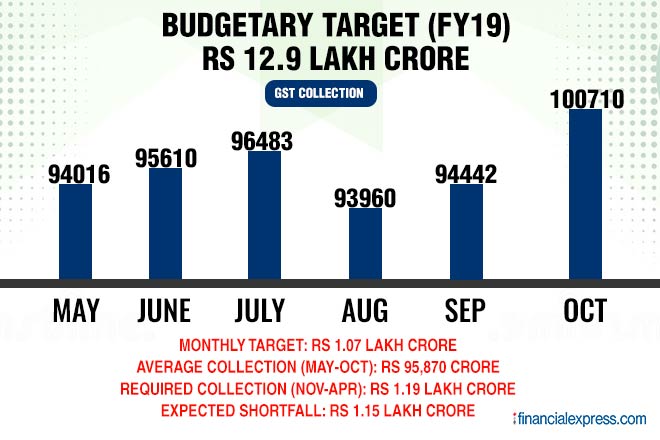

- In Budget 2018, the government had set the GST revenue target for the financial year 2018-19 at Rs 12 lakh crore, i.e a monthly average of Rs 1.07 lakh crore.

- The total collection by the government between May to October 2018 has been Rs 5.75 lakh crore, averaging Rs 95,870 crore.

- However, revenue collections from GST declined for the second consecutive month in December to Rs. 94,726 crores from Rs. 97,637 crores in November and Rs. 1,00,710 crores in October.

- Thus, in order to achieve the year-end target, GST collections over the next three months will have to reach an average of Rs. 1,34,900 crores.

- But the GST Council has so far taken more than 190 items out of the highest tax rate of 28% into lower slabs.

- Hence, the pressure on GST revenues will persist and the government is likely to miss the revenue target.

- The Council is also considering a relaxation in the GST norms for micro, small and medium enterprises.

- It has planned to raise the annual sales threshold for compulsory GST registration from Rs. 20 lakhs to over Rs. 50 lakhs.

- Such relaxations will also further reduce the tax revenue.

- Even the other possible revenue alternatives for the government, including direct tax or disinvestment receipts, are unlikely to compensate the GST shortfall.

What are the concerns?

- States’ revenue collections under the GST regime have been uneven and a GST Council panel is examining inter-State variations.

- The Centre is also bound to compensate States for revenue shortfalls for the first five years of the GST regime.

- Thus the Centre should either decide to drop its fiscal deficit goals or should reduce its planned capital expenditure to compensate for revenue shortfalls from GST.

- Also, revenue collections of GST in the month of November 2018 fell, despite the total number of returns filed that month hit a high of 72 lakhs from 55 lakhs at the beginning of the fiscal.

- Thus, the higher compliance of taxpayers didn’t necessarily translate into higher collections from GST.

- Despite these concerns, GST collections seems inevitable for a

- consumption-led investment and to take the economy to an 8% growth path.revival

Source: The Hindu