What is the issue?

The rupee’s relentless slide in recent weeks has led to comparisons with the situation that prevailed in 2013.

What was the 2013 episode?

- Indian economy was facing a downfall, where it witnessed a record low of rupee value of 68.80.

- Oil prices had sky-rocketed to $140/barrel (it is less than $ 90 today).

- India imported 80% of the oil used in the country, and with the depreciated rupee, the subsidy burden of importing crude oil loomed higher.

- The pressure on Indian rupee and on import bill of crude oil was interdependent.

- The price rise was also caused by the US Fed’s ‘taper tantrum’, which signalled the winding up of quantitative easing (QE) and the hardening of policy rates.

- Quantitative easing was followed by US, post 2008 financial crisis, to increase money supply in the economy in order to further increase lending by commercial banks and spending by consumers.

- During 2013, US followed Tapering, which is a system of slowly reducing the amount of money the Fed puts into the economy, which gradually reduces the economy's reliance on that money.

- This created an adverse impact on FPI investments, wherein there was a reversal of existing stocks as well as a slowdown in fresh flows as less liquidity was available.

- Hardening of policy rates in the US also attracted portfolio investments from emerging markets.

- There were also severe demand-supply mismatches of oil at the global level.

- The situation in India became worse and was very well compared with the historical economic crisis of 1991.

How does India stand today?

- The recent depreciation of rupee is getting compared with the scenario that was prevailed in 2013 and also call for similar solutions.

- But the Indian situation is actually quite different in 2018.

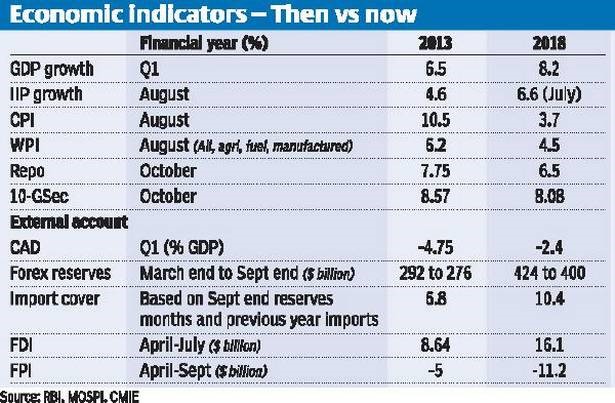

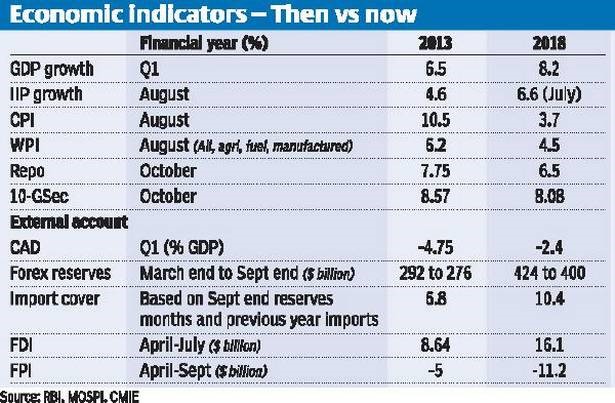

- The position in 2018 is far more comfortable in almost all the parameters except foreign portfolio investment (FPI).

- FPI flows have been negative in both the episodes, and this has got to do more with the Federal Reserve driving such actions.

- The continuous increase in interest rates by the Federal Reserve is the main reason for the FPI flows to turn negative now.

- So the RBI was expected to increase rates this time to even out the interest rate differential between the two regimes.

- The other parameters like the CAD, import cover, FDI and other indices look healthier than before which gives a great deal of confidence to the policy makers.

What are the concerns?

- Oil factor - It remains to be seen whether India will be able to strike a deal with Iran within the US overall framework of sanctions.

- This combined with the OPEC reaction to lesser oil from Iran will determine the direction of oil prices.

- Also, if US is not able to supplement supplies with its own shale reserves to matchup oil supply, then the price could go up further.

- The US-China trade war will continue to keep the dollar stronger and make the rupee volatile.

- Import tariffs - Import tariffs on several goods have been increased to lower the growth in imports.

- But since the quota system became tighter after the WTO was set up, there aren’t too many other steps that can be taken to improve the CAD of India.

- Forex reserves - Currently with forex reserves at around $400 billion, import cover is comfortable.

- But the decline in reserves of around $25 billion this year can be attributed mainly to the RBI selling dollars of around $15-16 billion to stem the rupee’s fall.

What should be done?

- RBI recently allowed forex borrowings for working capital by oil marketing companies(OMC) under the automatic route with immediate effect.

- All the state-run OMCs will now be able to raise external commercial borrowings (ECBs) for working capital purposes with a minimum average maturity of three to five years from all recognised lenders under "the automatic route".

- Under the liberalised norms, individual state-run refiners are allowed to borrow up to USD 750 million, while the overall borrowings are capped at USD 10 billion.

- In addition to the liberalised norms for oil companies, a sovereign bond or NRI bond could also be made to increase foreign currency inflows.

- But such bonds are expensive and are repayable and hence the future risk also needs to be weighed appropriately.

- India has no control over the extraneous factors like trade wars, Federal Reserve actions and the rising prices of oil.

- But the RBI needs to hold control over the fundamentals within our economy that are driving the rupee further.

Source: Business Line