What is the issue?

- The Finance Ministry released the recent numbers on tax collections, with GST registering an all time high.

- It offers hope for pick up in economic growth rate in the coming quarters.

What are the highlights?

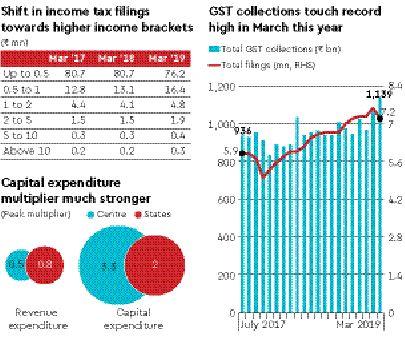

- Income tax - For the first time in the history of income tax returns, the number of returns filed dropped in FY19.

- It is down to 6.68 crore from 6.74 crore in FY18, indicating the diminishing effect of demonetisation.

- Income Tax compliance has been lower in FY19 compared to the past few years.

- The ratio of actual filings to registered filers dropped to 79.1% in FY19 from an all-time high of 91.6% in FY18.

- Against the revised estimates, overall direct tax collection in FY19 fell short by Rs. 50,000 crore.

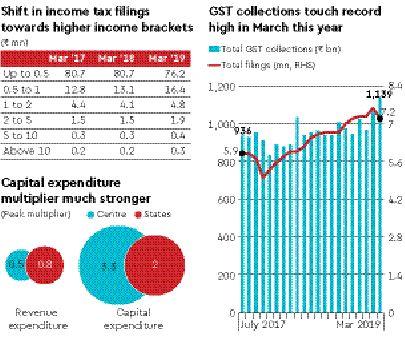

- GST - In indirect taxes, the goods and services tax (GST) collections was around Rs.1.13 lakh crore in March, 2019.

- This is the highest recorded since the tax regime was introduced in July 2017.

- Strong collections over the last two months reflect the growing compliance with indirect tax laws.

- They represent an increase of over 10% compared to the same month a year ago.

What are the possible reasons on GST collections?

- It is largely attributed to increasing compliance among businesses as a result of push by the tax authorities to widen the tax base.

- The tax rate cuts by the GST Council in December too may have spurred higher volumes for some goods and services.

- The rush to pay tax arrears at the end of the financial year may have been another seasonal factor.

- Enforcement action by tax authorities to collect more revenue from registered taxpayers who have not been filing returns could have helped too.

What is the significance?

- The growth rate of the economy fell from 8.2% in the first quarter to 7.1% in the second and 6.6% in the third. Click here to know more.

- Given this, the latest GST numbers offers some hope for better growth momentum in 2019-20.

- Healthier GST collections, if sustained, will also mean less pressure on the Centre to cover its fiscal deficit.

What lies ahead?

- The government will have to look at ways to expand the tax base in the context of direct tax collections.

- Weak growth in tax filings is likely to have further impacts in an already stressed fiscal space.

- On the other hand, with collections hitting a record high in GST, the next step should be to simplify the tax regime.

- To encourage greater compliance, there must be efforts to make it easier for small firms to remain in the tax net.

Source: Financial Express, The Hindu