7667766266

enquiry@shankarias.in

Why in news?

In 2020, when the currencies of other emerging economies such as China, South Korea, Taiwan and the Philippines gained more than 5% against the US Dollar, the Rupee declined 2.3%

What are the reasons for Rupee’s weakness?

What apprehensions point towards increased strength in the rupee?

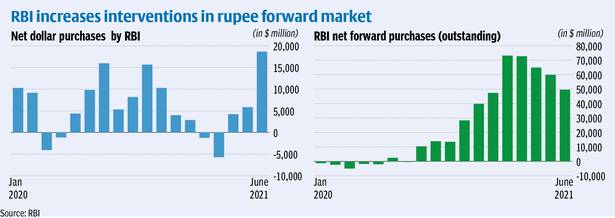

What is RBI’s dilemma?

The spot market is where financial instruments, such as commodities, currencies, and securities, are traded for immediate delivery

What options have been left out with RBI?

Source: Business Line