7667766266

enquiry@shankarias.in

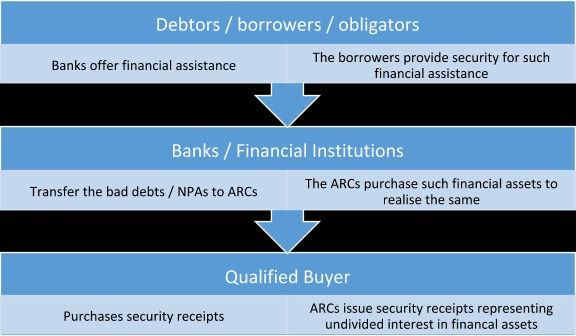

In most jurisdictions, national bad banks set up to clean the balance sheets of banks make losses but India has a long-standing industry of privately-held asset reconstruction companies set up in 2002 under the SARFAESI Act.

According to RBI’s Financial Stability Report, the gross non-performing assets (GNPA) ratio of banks may rise to 9.8% by March 2022 from the 7.48% in March 2021.

Within the bank groups, public sector banks' (PSBs') GNPA ratio is 9.54% in March 2021.

References