7667766266

enquiry@shankarias.in

Why in news?

With the US' inflation rate at 9.1% in June, the highest in 40 years, Yield inversion, soft-landing and reverse currency war is seen in the big picture.

What has been happening in the global economy?

What are bonds?

What are bonds yields?

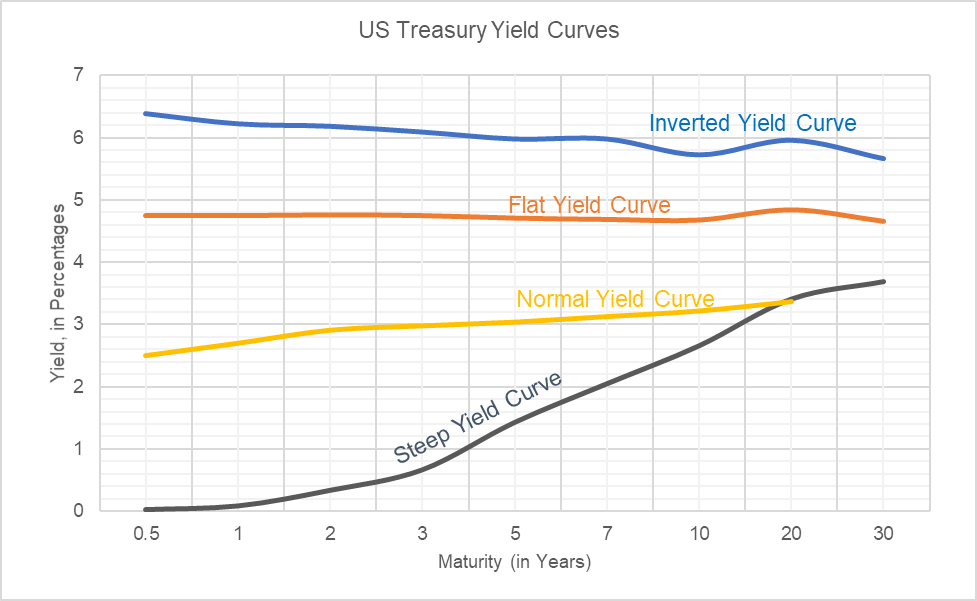

What is bond yield curve inversion?

What is Soft-landing?

What is Reverse Currency War?

What is the way forward?

Reference