7667766266

enquiry@shankarias.in

What is the issue?

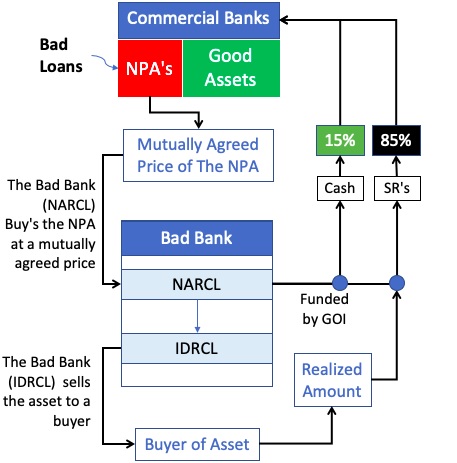

The RBI recently gave license to National Asset Reconstruction Company Limited (NARCL), popularly known as a bad bank but the absence of a clause about the lifespan of NARCL may lead to a moral hazard problem.

Reference