7667766266

enquiry@shankarias.in

Click here for Part II and here for Part I

Why in news?

The Union Minister for Finance and Corporate Affairs, Ms. Nirmala Sitharaman tabled the Economic Survey 2018-19 in the Parliament.

What are the key highlights?

EXTERNAL SECTOR

AGRICULTURE AND FOOD MANAGEMENT

INDUSTRY

INFRASTRUCTURE

SERVICES SECTOR

SOCIAL INFRASTRUCTURE, EMPLOYMENT AND HUMAN DEVELOPMENT

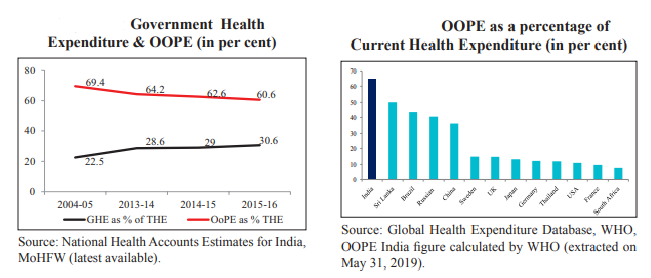

Note: OOPE - Out of Pocket Expenditure; THE - Total Health Expenditure

Source: Ministry of Finance Website