7667766266

enquiry@shankarias.in

NK Singh Committee:

On what sector the budget should focus on?

Has the government done anything to address these issues?

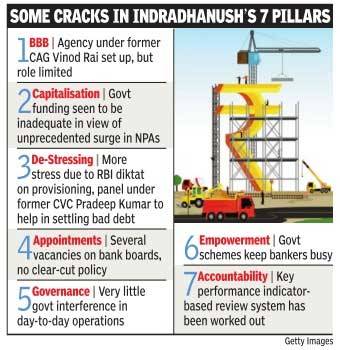

What does the Indradhanush plan promise?

Is Indradhanush a successful measure?

Concluding remarks:

Barring a few cosmetic changes, nothing significant has been done to revive the public sector banks. I would love to see the finance minister using this budget to move forward with a concrete reform agenda.

Category: Mains | GS – III | Economy

Source: Live Mint