In light of the “Bihar Caste-based Survey, 2022” which showed that almost 33% of Bihar’s people are poor, the State government seeks Special Category Status.

|

About |

Special Category Status |

Special Status |

|

Provision |

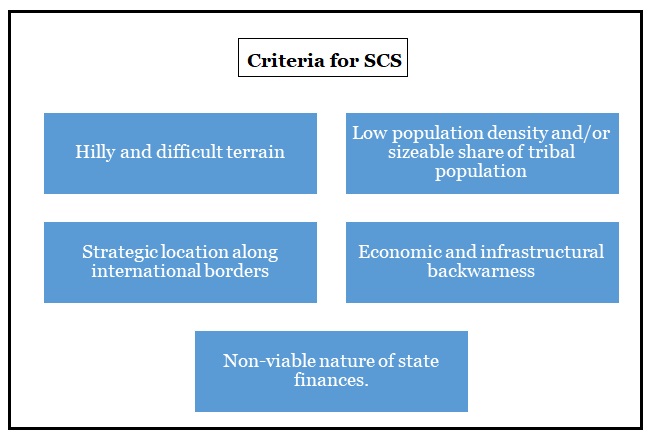

It is granted by the National Development Council, which is an administrative body of the government |

The Constitution (Article 371 to 371-J) provides special status through an Act that has to be passed by 2/3rd majority in both the houses of Parliament |

|

Powers |

Deals only with economic, administrative and financial aspects. |

Empowers them with legislative and political rights. |

|

Applicable States |

11 States - Assam, Sikkim, Manipur, Nagaland, Himachal Pradesh, Mizoram Meghalaya, Tripura, Arunachal Pradesh, Uttarakhand and Telangana. |

12 States- Maharashtra, Gujarat, Nagaland, Goa, Assam, Manipur, Andhra Pradesh, Arunachal Pradesh, Telangana, Sikkim, Mizoram and Karnataka. |

|

Other States demanding SCS |

|

Reference