7667766266

enquiry@shankarias.in

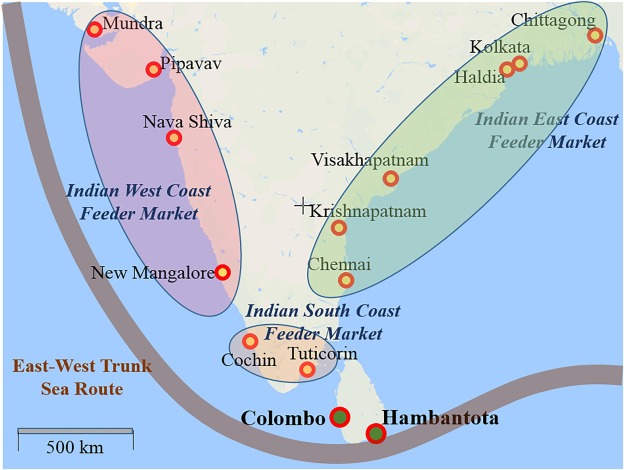

India is losing revenue on nearly a quarter of its own container cargo every year and much of this loss is of ports on the eastern coast.

Reference