7667766266

enquiry@shankarias.in

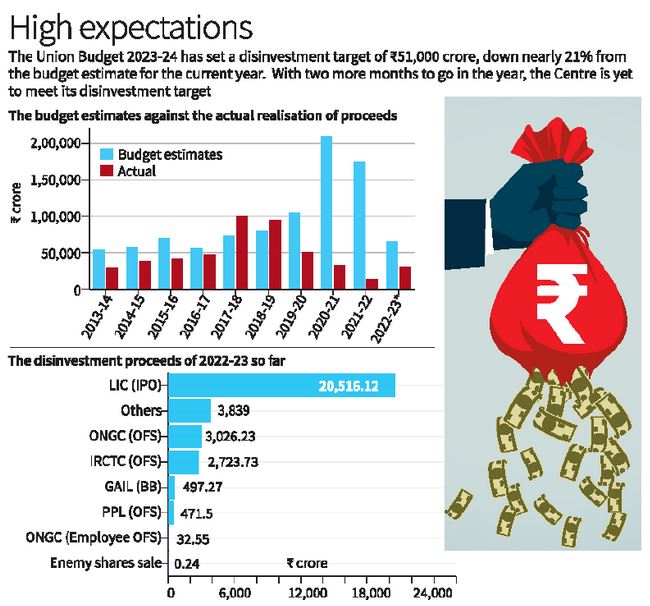

In the Union Budget 2023-24, a disinvestment target of Rs 51,000 crore, has been set, which is nearly 21% less from the budget estimate for the current year.

To know about the key highlights of the Budget 2023-24, click here

References