7667766266

enquiry@shankarias.in

Why in News?

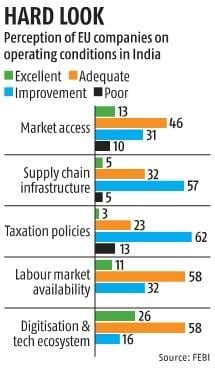

European Union (EU) companies operating in India want New Delhi to streamline or remove non-tariff barriers.

EU is India’s largest trading partner, accounting for 12.2% of India’s goods trade in 2023 while India is the EU’s 9th -largest trading partner, accounting for 2.2% of total EU trade in goods during the same year.

Reference