7667766266

enquiry@shankarias.in

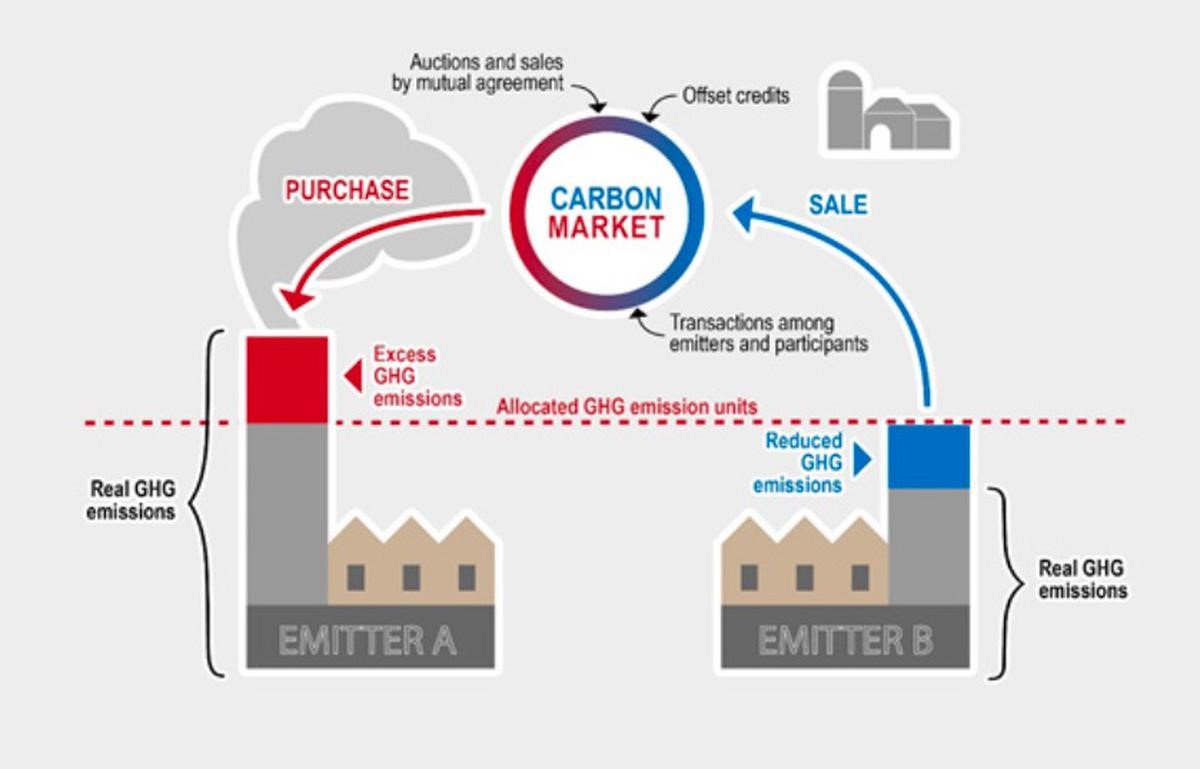

The Parliament passed the Energy Conservation (Amendment) Bill, 2022 declining the Opposition’s demands to send it for scrutiny to a parliamentary committee and amid concerns expressed by members over carbon markets.

Voluntary markets

Compliance markets

The World Bank estimates that trading in carbon credits could reduce the cost of implementing NDCs by more than half - by as much as $250 billion by 2030.

NDCs are climate commitments by countries setting targets to achieve net-zero emissions. These countries have agreed to update every 5 years.

Article 6 of the Paris Agreement provides for the use of international carbon markets by countries to fulfil their NDCs.

Reference