7667766266

enquiry@shankarias.in

What is the issue?

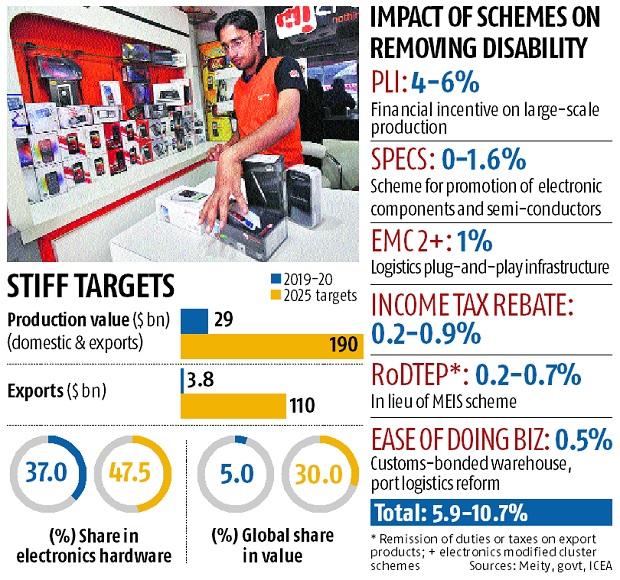

To make India a global hub for electronics manufacturing, the government must come up with more incentives beyond The National Policy on Electronics 2019

What is India’s position with respect to electronics?

What are the issues in this sector?

What initiatives have been taken to promote electronics manufacturing?

What can we learn from China and South Korea?

China and South Korea control around 48 per cent of the electronics manufacturing market in the world

Source: The Hindu, Business Line