7667766266

enquiry@shankarias.in

Why in news?

CBDT has notified the rules regarding the taxation of the interest on the excess Employees’ Provident Fund contributions.

What is the Employees Provident Fund?

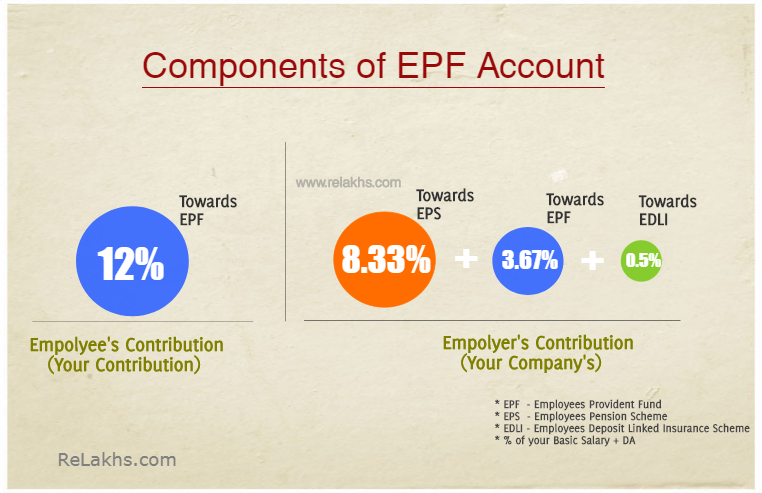

EPFO is a statutory body under the Labour and Employment Ministry. The Central Board of Trustees administers a contributory provident fund (EPF), pension scheme (EPS) and an insurance scheme for the workforce engaged in the organized sector in India.

What are provident fund taxes?

What are the CBDT rules?

The rules were notified by the Finance Ministry through an amendment to the Income-Tax Rules, 1962.This will come into effect from April 1, 2022.

What are the challenges?

Source: Indian Express, Economic Times