7667766266

enquiry@shankarias.in

What is the issue?

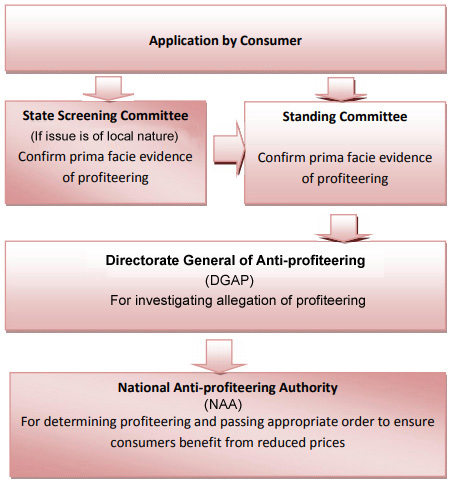

The recent cases taken up by the National Anti-Profiteering Authority (NAA) have raised concerns as to its purpose and powers.

What is the recent case?

What is the recent proposal in this regard?

What are the concerns?

Source: Business Standard