7667766266

enquiry@shankarias.in

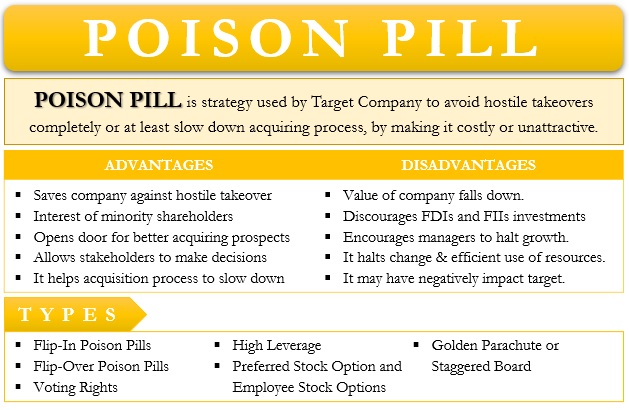

Publicly listed companies are most exposed to threats of a hostile takeover. However, with time, they have come up with varied defence mechanisms to prevent such takeovers.

References