7667766266

enquiry@shankarias.in

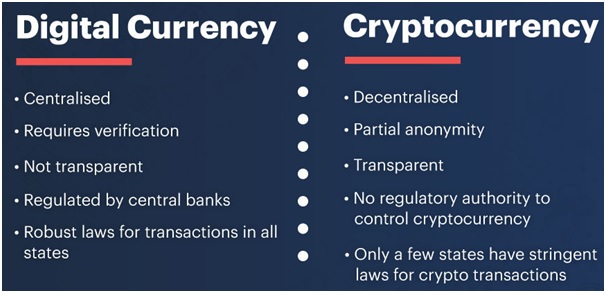

The central bank must note that a Central Bank Digital Currency (CBDC) can only be a fiat currency and not a crypto.

Double-spending is the risk that a cryptocurrency can be used twice or more. It occurs when someone alters a blockchain network and inserts a special one that allows them to reacquire a cryptocurrency.

References