7667766266

enquiry@shankarias.in

|

Tax Haven |

|

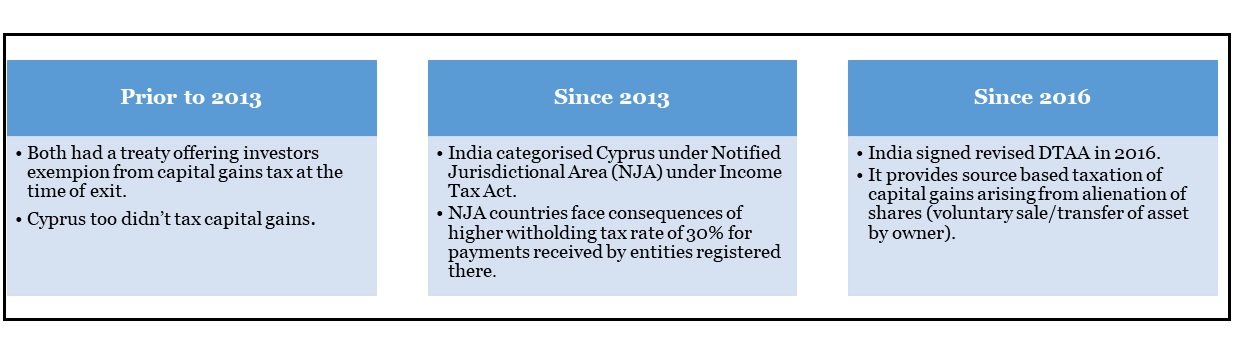

DTAA is a tax treaty signed between any two/multiple countries so that taxpayers can avoid paying double taxes on their income earned from the source country as well as the residence country.

At present, India has double tax avoidance treaties with more than 80 countries around the world.

Quick facts

|

Offshore Investigations |

Year |

|

HSBC Swiss Leaks |

2015 |

|

2016 |

|

|

2017 |

|

|

2021 |

References

Adele Young 2 months

Doodle Jump 2 offers a nonstop arcade experience where players must balance skill and focus to reach new heights without falling or missing a single platform.