7667766266

enquiry@shankarias.in

Why in news?

The ‘Report of the Working Group on Digital Lending including Lending through Online Platforms and Mobile Apps’ has been released by the RBI.

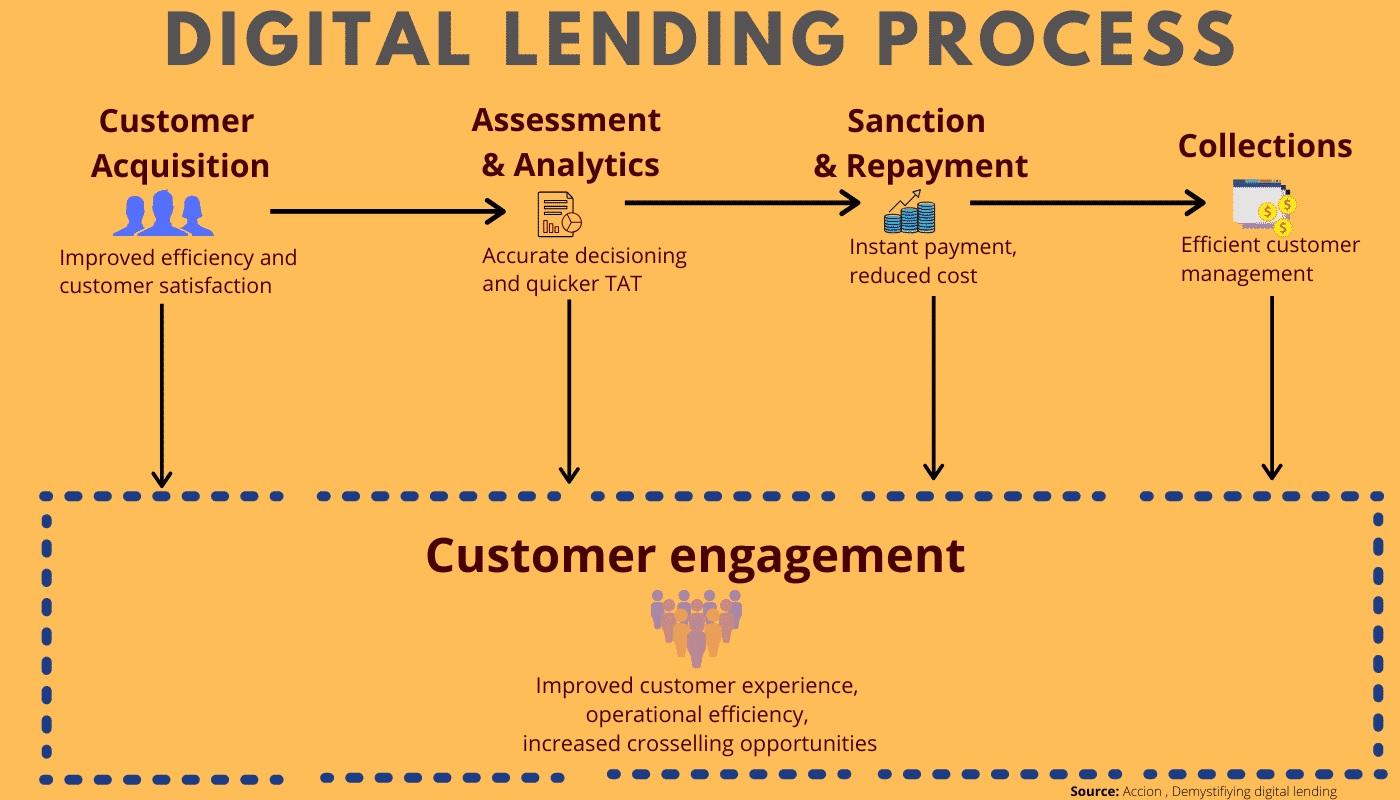

What is digital lending?

What digital lending models have been in place?

What is the significance of digital lending?

What are the concerns of digital lending?

RBI report finds 600 illegal loan apps operating in India which are available on several app stores for Android users.

What are the key recommendations on digital lending?

What does the draft rule imply?

Reference