7667766266

enquiry@shankarias.in

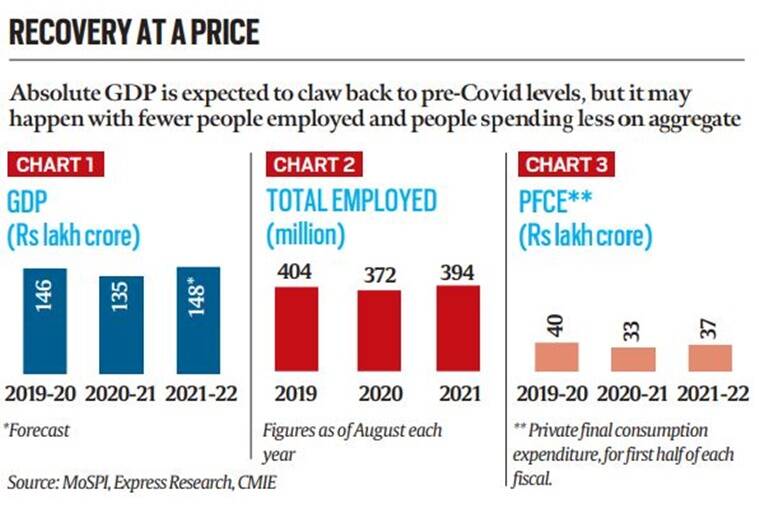

India’s GDP is expected to return to pre-Covid levels by the end of 2021-22 but some sectors are struggling more than others, the number of unemployed remains high, and private consumption is low.

Reference