7667766266

enquiry@shankarias.in

What is the issue?

How will this impact India?

What concerns does this pose?

What options does India have?

Source: The Hindu, Indian Express

Quick Facts

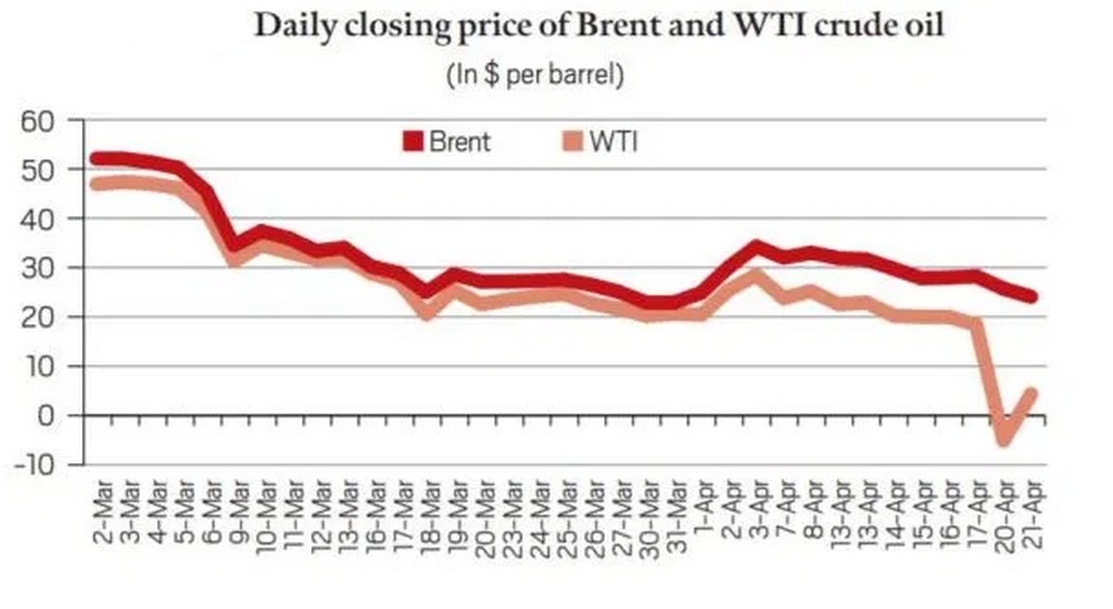

Brent Crude