7667766266

enquiry@shankarias.in

Why in news?

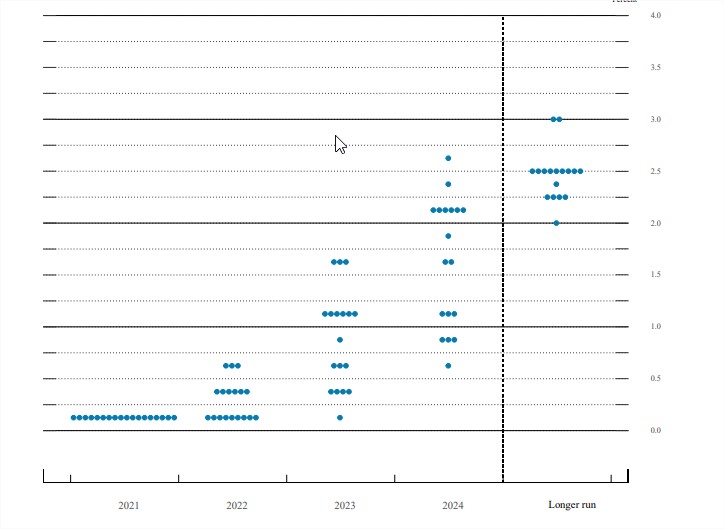

The Federal Reserve announced that it will reduce its asset purchases by $15 billion a month in November and December 2021 which made commentators to look forward to the actual US Fed dot plot on interest rates.

To know more about the Taper Tandrum, click here

Reference