As the monsoon sweeps across India, Cities in particular, bear the brunt of the fury of rains and Municipal corporations find themselves perennially underprepared for these seasonal crises.

|

Revenues Sources of Municipal Bodies |

|

|

Expenditures of Municipal Bodies |

|

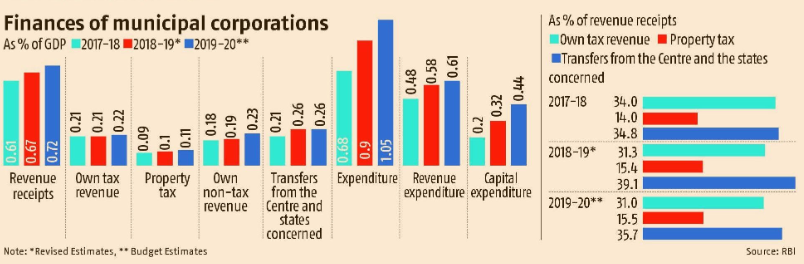

A recent study by ICRIER, based on data from 37 of the 53 municipal corporations with populations exceeding 1 million, revealed a decline in total municipal revenue as a percentage of GDP from 0.49% in 2012-13 to 0.45% in 2017-18.

Property taxes contributed just 13.19% of revenue receipts for the Brihanmumbai Municipal Corporation (BMC), India’s wealthiest local body, over the past five years.

Municipal bonds are debt securities issued by municipal authorities to fund public projects such as infrastructure development, public schools, and utilities.