7667766266

enquiry@shankarias.in

Why in news?

What is FRBM Act?

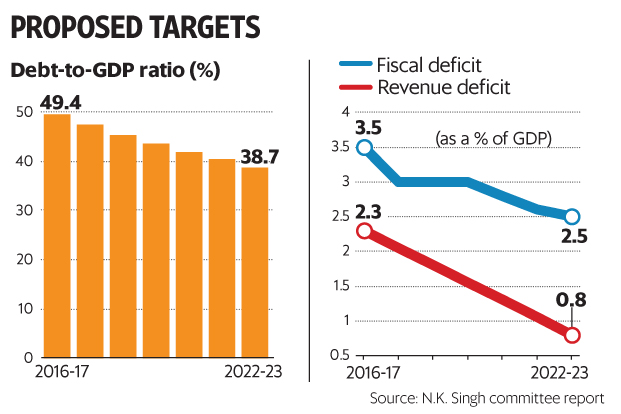

What the panel has recommended?

Source: Business Standard & Live Mint

Ravi Ranjan Singh 8 years

Sir isn't it panel has declined taking primary deficit as the main anchor point. They say the country to have a fiscal framework with an operational target of primary deficit it cant ignore interest payment component which constitutes 90% of fiscal deficit component.