7667766266

enquiry@shankarias.in

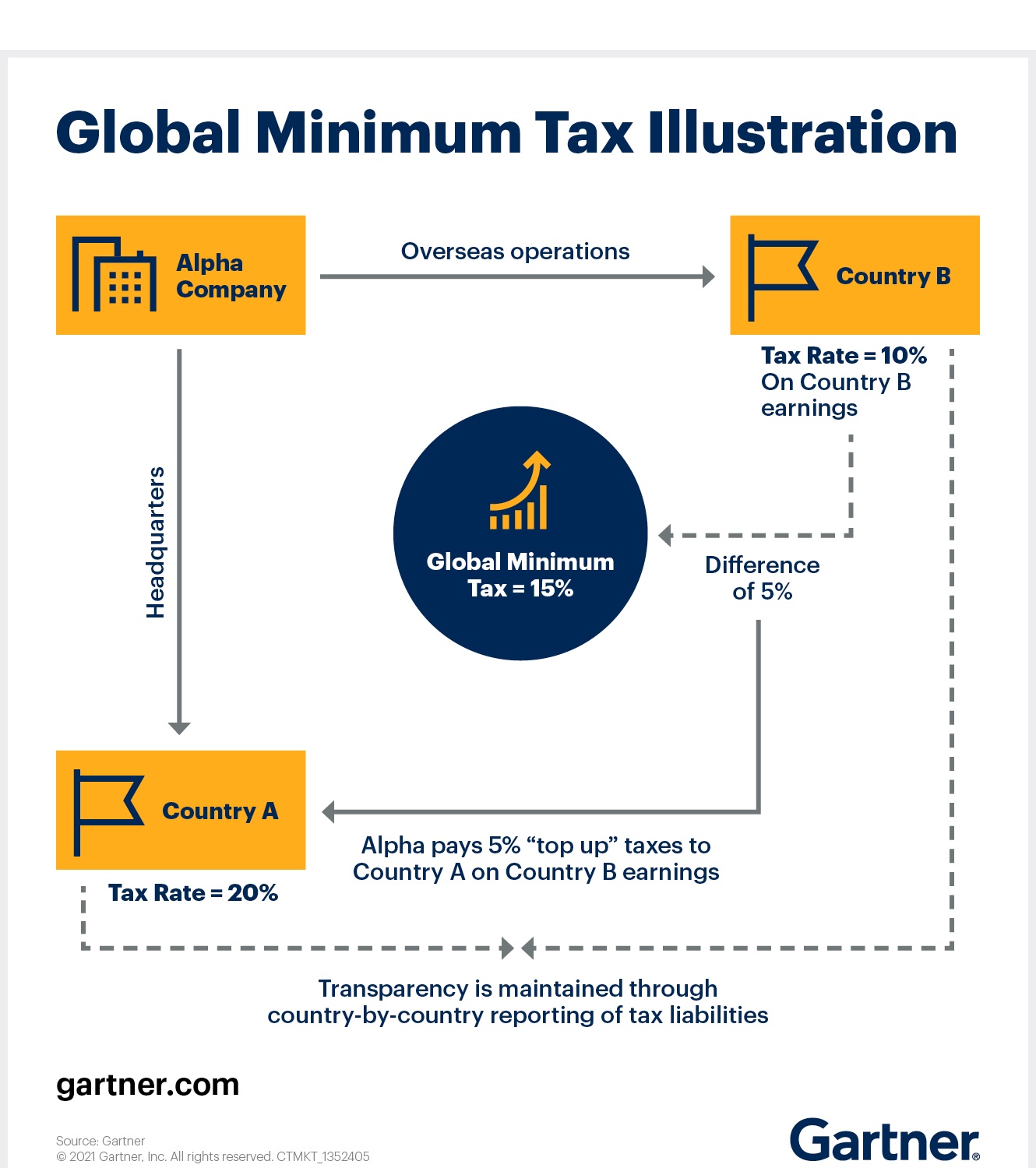

Around 136 countries have signed an agreement at the OECD meeting to redistribute taxing rights and impose a global minimum corporate tax on large MNCs operating globe over.

India, China, Russia, Germany and other countries have signed the agreement, which has to be implemented from 2023.

Source: The Hindu