The Gender Budget reached 1% of GDP in the Budget 2024-25 for the first time, and overall allocations currently stand at more than ₹3 lakh crore for pro-women programmes.

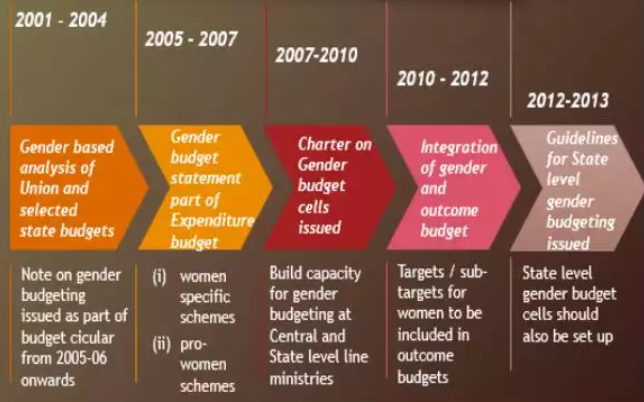

It was introduced in Australia in early 1980’s and is currently implemented in more than 100 countries. Over 90 countries have adopted Gender budgeting and each one has had a unique experience with its implementation.

|

Components of Gender Budgeting Statement |

||

|

Part |

Statement |

Schemes |

|

A |

It reports expenditures in schemes with 100% allocation for women. |

Namo Drone Didi, Prime Minister's Girls' Hostel, Safe City Projects, Nirbhaya Fund Transfer, DISHA Programme for women in science etc. |

|

B |

It reports programmes with allocations of 30-99% for women. |

Krishonnati Yojna, PM Schools for Rising India, Samagra Shiksha, PM POSHAN etc. |

|

C |

It reports pro-women schemes with less than 30% provisioning for women.

|

PM Kisan Yojana |

|

Status of Gender Budgeting in Budget 2024-25 |

|