7667766266

enquiry@shankarias.in

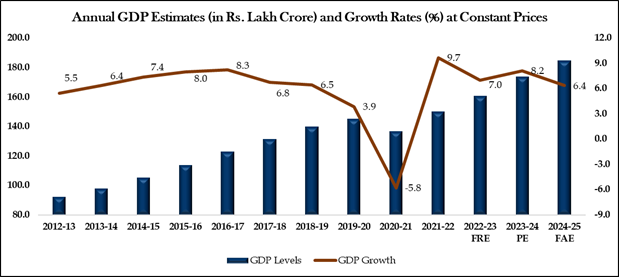

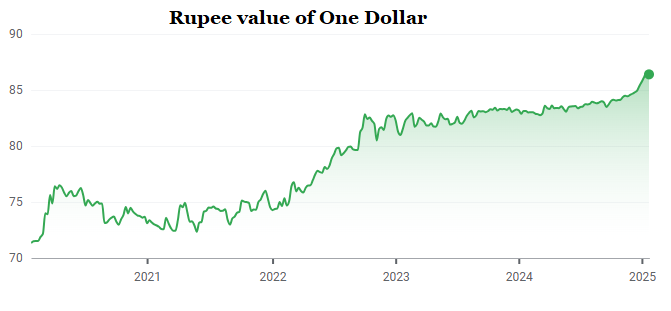

Recently Indian economy has been facing slowdown across major sectors.

Number of Indians holding investment accounts went from 22 million to 150 million, in the last decade.