7667766266

enquiry@shankarias.in

The Finance Ministry’s move to bring in virtual digital assets under the money laundering law is aimed at widening the taxation and regulatory net and giving teeth to agencies.

The burden of proof is a legal standard in which the accused has to prove that the property has not been obtained through proceeds of crime.

Objectives

Offences

Penalties

Authorities

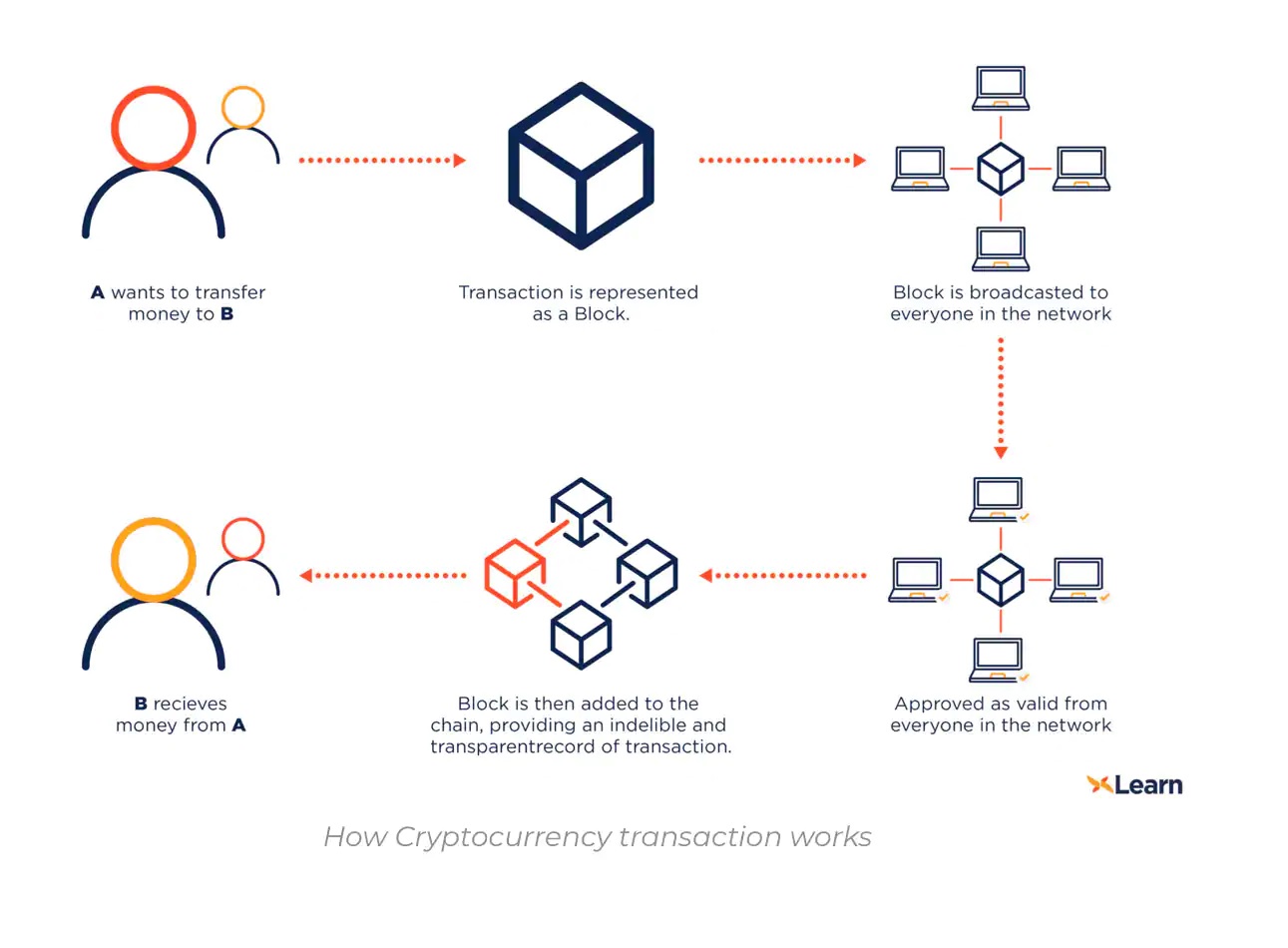

Satoshi Nakamoto conceptualised an accounting system in 2008 financial crisis which has mooted the idea of blockchain.

Bitcoin is the largest in the world according to market capitalisation, followed by Ethereum.