7667766266

enquiry@shankarias.in

Why in News?

Regional Rural Banks losing ground to private banks amid tech challenges.

|

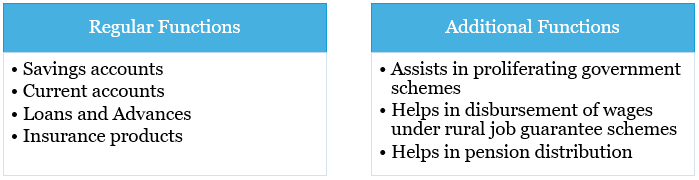

Status of RRB’s in India |

|

|

Digital deficit |

|

|

Digital deficit in RRBs |

|

Non-Performing Assets (NPAs) are the assets which ceases to generate income for the bank.

What are the steps taken to improve the status of RRB’s?

A 2022 National Bank for Agriculture and Rural Development (NABARD) report highlighted that RRBs need to enhance their loan recovery processes through technology, policy improvements, and best Practices.