7667766266

enquiry@shankarias.in

What is the issue?

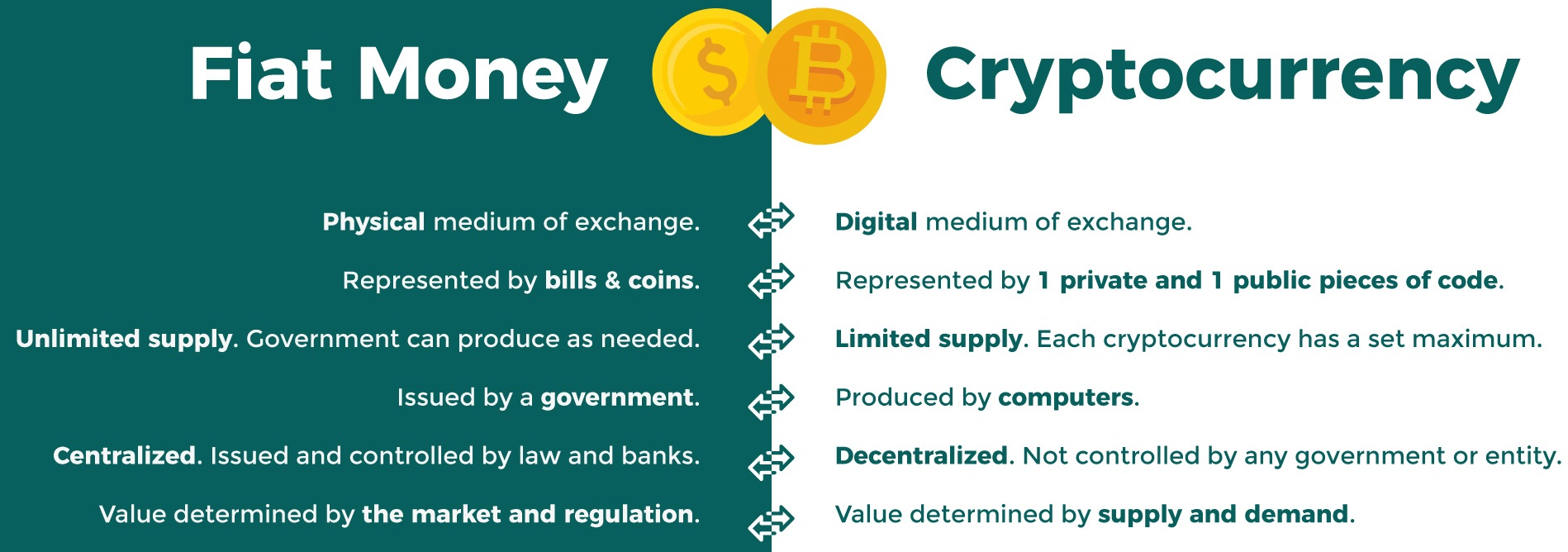

The development of Bitcoin and other cryptocurrencies in a little over a decade has spawned a parallel universe of alternative financial services. Here is a look at them.

What do crypto businesses offer?

Benefits

Why such high yields?

What is a stablecoin?

Risks

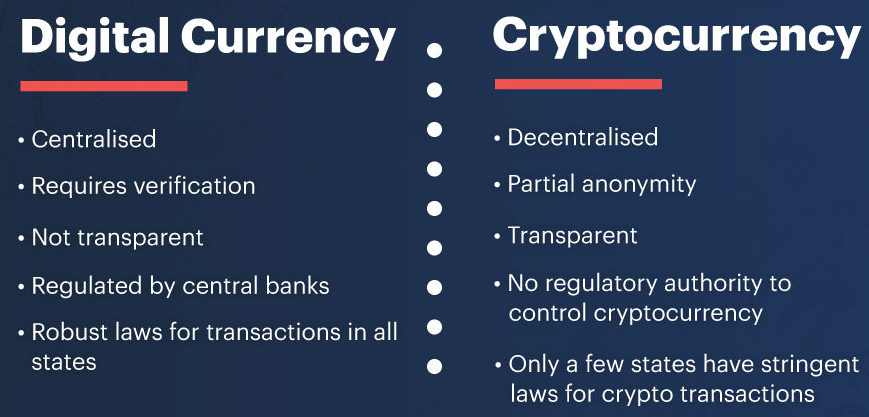

What is a central bank digital currency?

What is DeFi?

What could be done in the future?

Source: The Indian Express

Related links:Official Digital Currency