7667766266

enquiry@shankarias.in

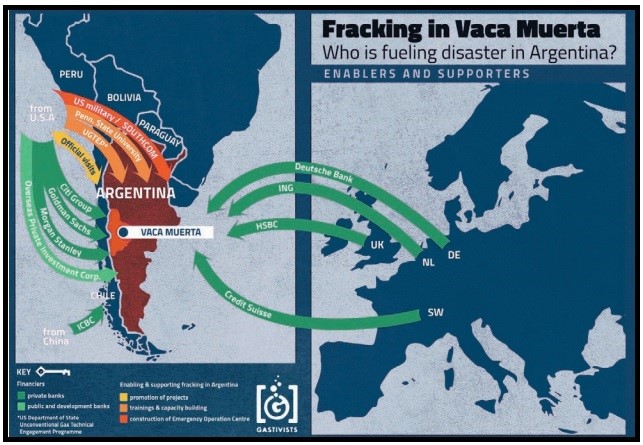

Debit-Fossil Fuel Trap report shows that Global North-imposed debt is locking the Global South into fossil fuels.