7667766266

enquiry@shankarias.in

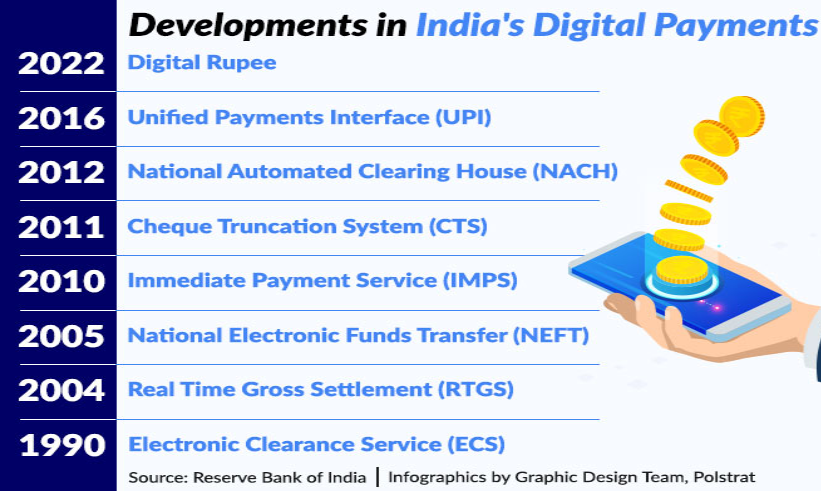

Recently, some fintech companies showed interests to join the India’s central bank’s digital currency project.

To know more about CBDC, click here

|

Benefits of Programmability of CBDC |

|

Fintech companies are the companies that offer financial services or applications that rely heavily on technology. They use technology to change how consumers interact with the financial industry.

Fintech companies such as GooglePay, PhonePe, Amazon Pay, MobiKwik, and Cred currently account for over 85% of digital payments via UPI.