7667766266

enquiry@shankarias.in

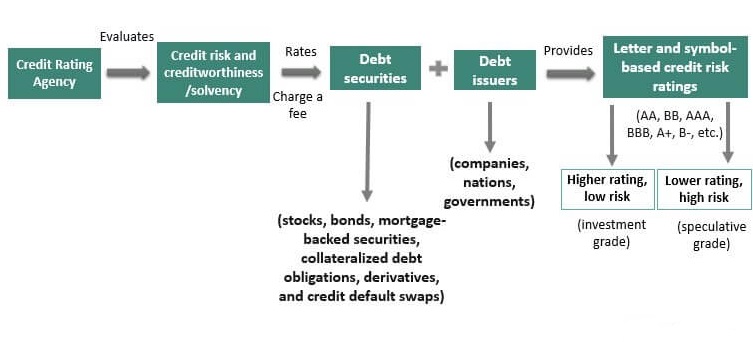

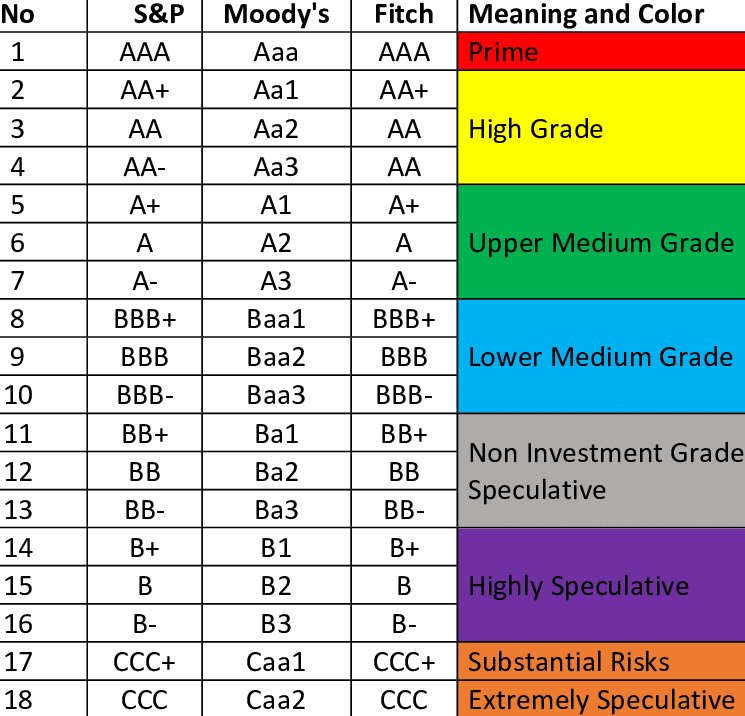

Recently Fitch, a global rating agency accorded “BBB” ratings to India’s sovereign rating.

References