7667766266

enquiry@shankarias.in

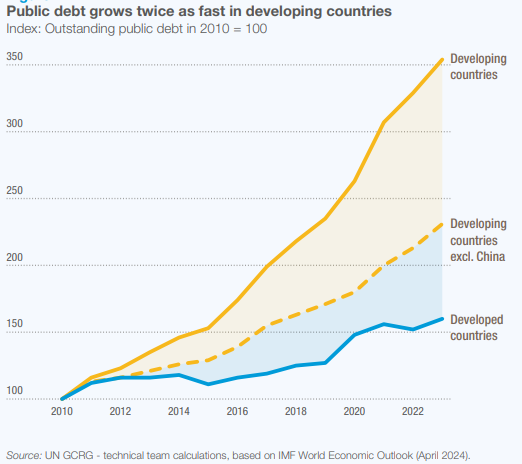

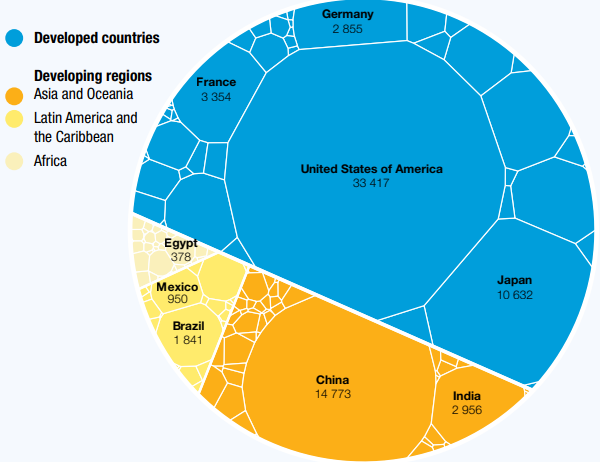

The recent UN report highlights a historic peak in public debt, reaching $97 trillion in 2023.

|

Public Debt of India |

|

According to the Reserve Bank of India Act, 1934, the RBI is both the banker and public debt manager for the government. It handles all the money, remittances, foreign exchange and banking transactions. The Union government also deposits its cash balance with the RBI.

|

UN Trade and Development (UNCTAD) |

|