7667766266

enquiry@shankarias.in

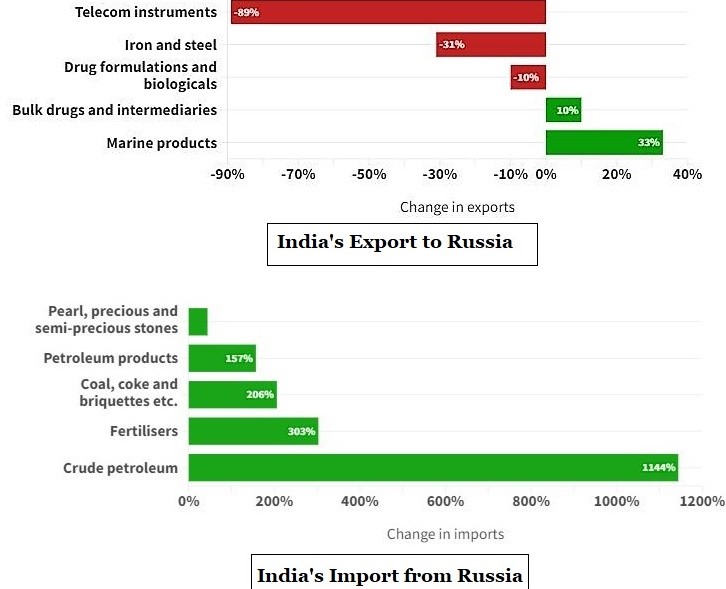

As India continues to import oil from Russia, it is getting tougher for the country to pay for it.

The Russian ruble or rouble is the official currency of the Russian Federation.

Daily average share for the rupee in the global foreign exchange market is 1.6%, while India’s share of global goods trade is 2%.