7667766266

enquiry@shankarias.in

What is the issue?

How has the progress been in the last few years?

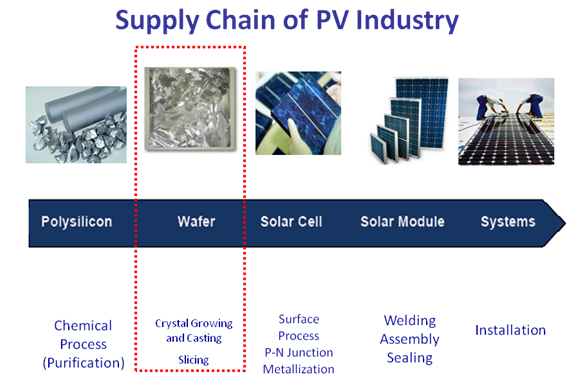

How is India's solar manufacturing potential at present?

How import dependent is India yet?

Why is it so?

What give China its edge over India?

What are India's efforts?

What should India's priorities be?

Source: The Hindu