7667766266

enquiry@shankarias.in

In FY23, India received lower Foreign Direct Investment (FDI) equity inflows than FY22 which raises the situation to analyse India’s FDI status.

Status of India’s FDI

Source- RBI’s Census on Foreign Liabilities and Assets of Indian Direct Investment Entities

In 2023, the top 5 States attracting FDI include Maharashtra, Karnataka, Gujarat, Delhi, and Tamil Nadu.

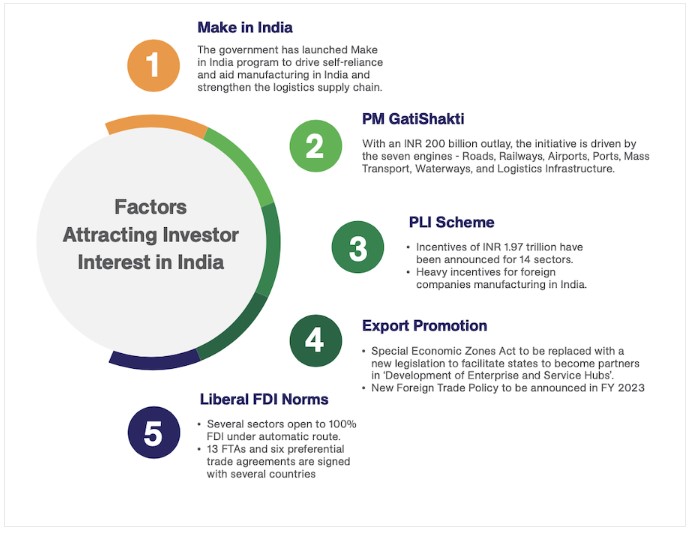

According to the 2023 Economic Survey, a rebound in incoming FDI is expected due to various factors like

India’s neighbouring countries are China, Bangladesh, Pakistan, Bhutan, Nepal, Myanmar, and Afghanistan.

References