7667766266

enquiry@shankarias.in

Financial creditors which had high expectations that the Insolvency and Bankruptcy Code (IBC), 2016 would help resolve the non-performing asset (NPA) problem, are deeply concerned over inordinate delays.

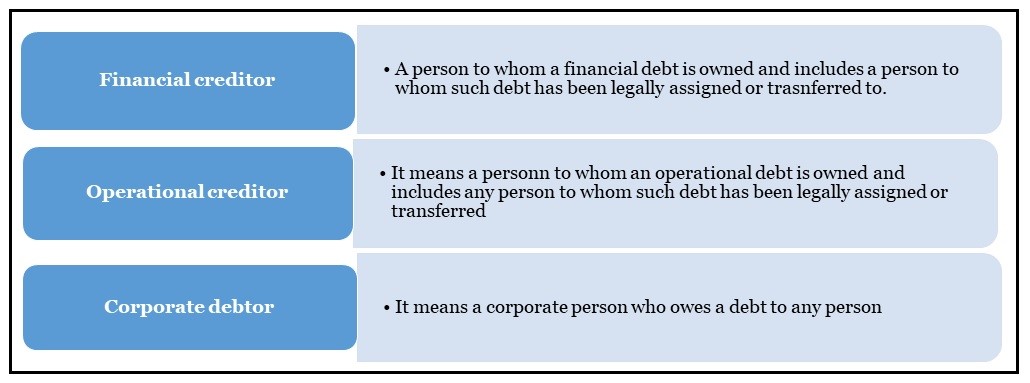

Insolvency is a situation where individuals or companies are unable to repay their outstanding debt.

|

Insolvency resolution |

Applicability |

Timeline |

|

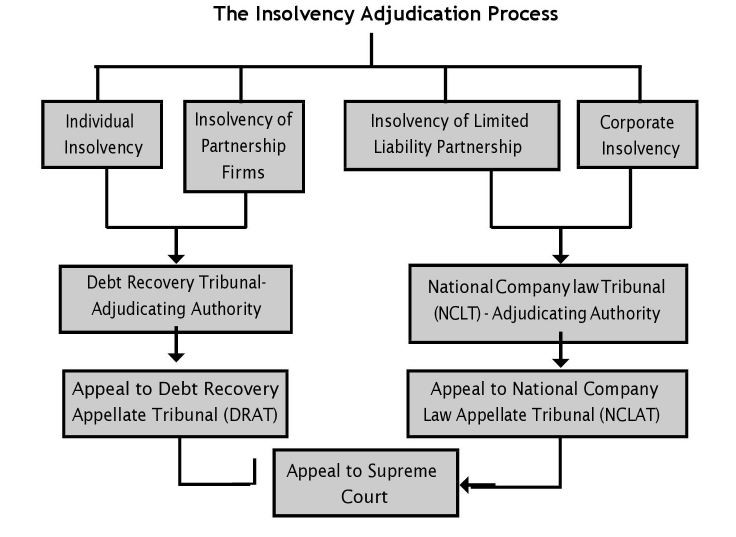

Corporate insolvency resolution |

Companies (Can be applied in the event of default of at least 1 lakh rupees) |

330 days |

|

Personal insolvency resolution |

Individuals and partnership firms |

180 days |

Liquidation means closing down the business of the corporate debtor

To know more about Insolvency Bankruptcy Code 2016 click here

References