7667766266

enquiry@shankarias.in

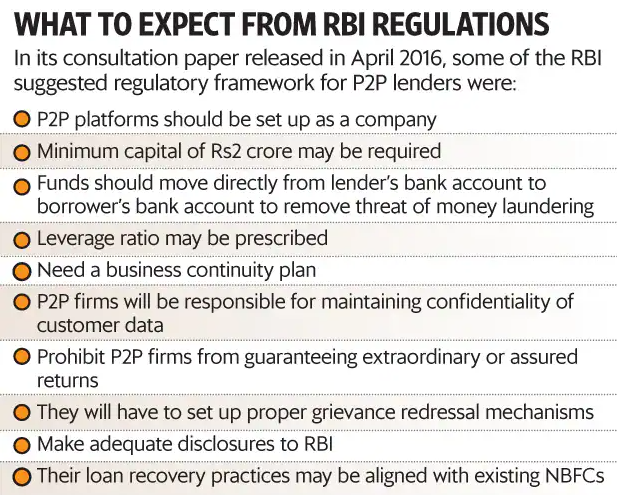

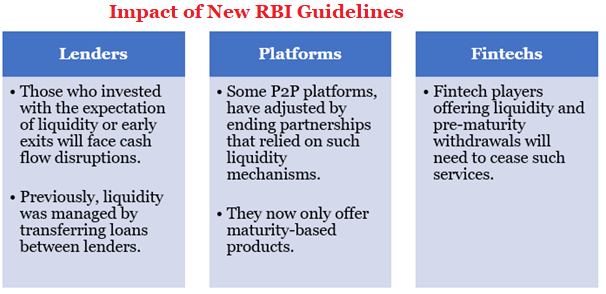

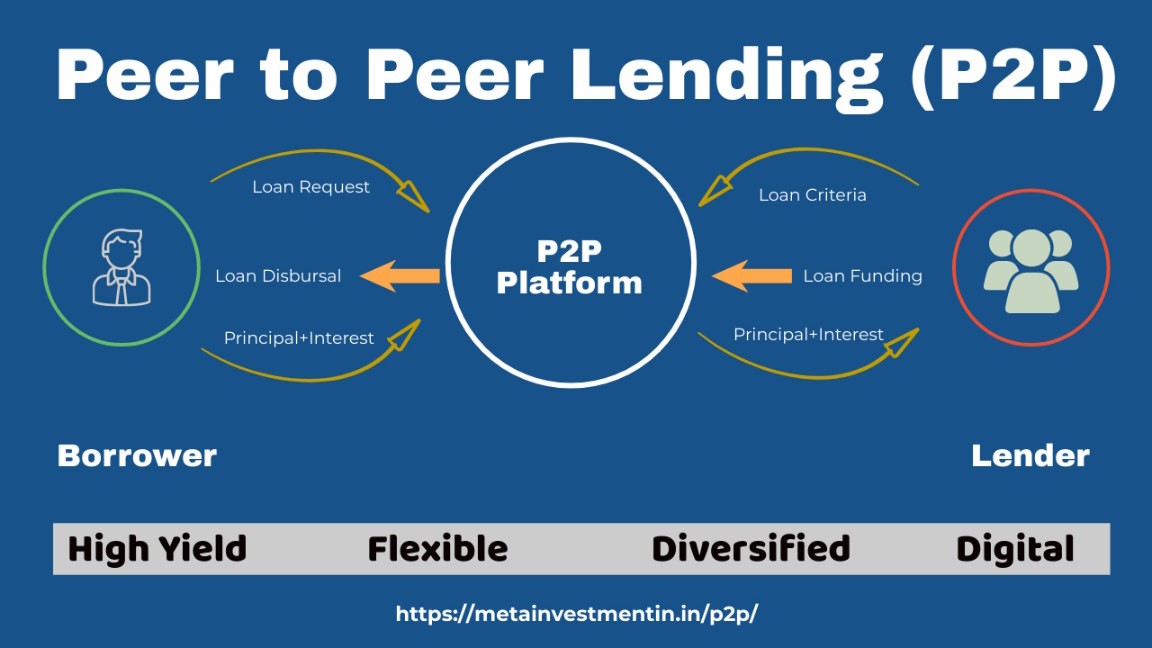

The Reserve Bank of India (RBI) has launched a crackdown on some P2P lending platforms for regulatory breaches, including Ponzi-like schemes, illegal deposit-taking, and aggressive recovery methods.

|

Regulation in India |

|

An escrow account is a bank account that holds money or assets until certain conditions are met by the parties involved in a transaction.

A NPA is a loan or advance for which the principal or interest payment remained overdue for a period of 90 days.