7667766266

enquiry@shankarias.in

What is the issue?

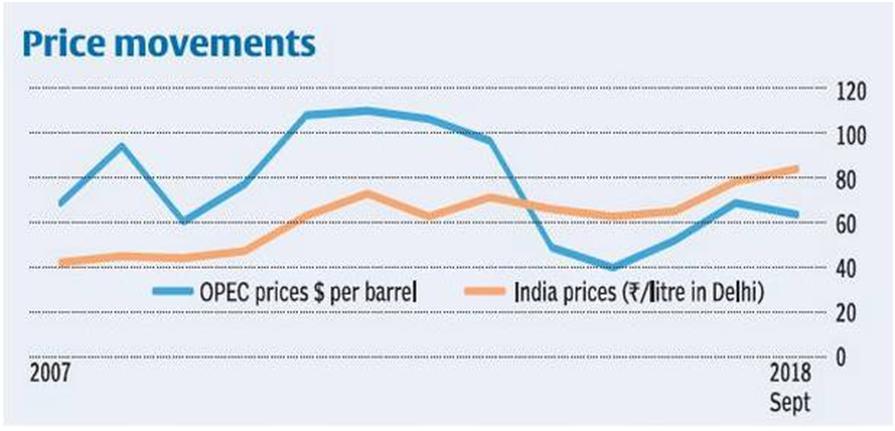

Petroleum prices are rising and there are considerable demands to the centre to reduce its excise duties on the product.

How the sector was deregulated?

What was the consequence?

What is the present scenario?

Should the states be held responsible?

What should the centre do?

Source: Business Line

Sai Krishna Durshetty 6 years

Sir/Madam, There is a photograph related to ZIKA VIRUS in this file, please go through it and edit the file,Thank you.

IAS Parliament 6 years

Thank you for bringing it to our notice. Keep Following.